What does financial independence mean? Technically, it’s about receiving a steady stream of money from your capital that exceeds the costs necessary to maintain your desired lifestyle.

However, there’s much more to this concept. In this article, I’ll share the journey that allowed me to maximize my income from work.

Income can come both from capital and from work, and preferably from both.

Initially, you need to focus on the income generated from work to maximize it and achieve the goal: financial independence.

Remember that your capital works 7 days a week, 24 hours a day, and 365 days a year. Additionally, it’s never sick and has more favorable taxation which, in Italy, is a maximum of 26%. I think you’ll agree with me that these are two clear advantages. These advantages are evident, but it’s equally important to consider the qualitative value of free time that accumulated capital can offer. The key is determining how much capital is necessary to allow us to no longer depend entirely on work, thus having the freedom to choose the activities we are most passionate about.

Work is an essential component of this journey, as the income it generates is the most powerful leverage at our disposal.

The Importance of Education

It’s important to start off on the right foot: a good university education can facilitate entry into the job market, even if the first steps can be challenging, often characterized by poorly paid internships and precarious contracts.

As you have seen, a good university education will definitely help you get into the job market. The beginning might prove to be extremely tough, with poorly paid internships and temporary contracts. Don’t get discouraged, it’s just the start of your career; the tough part comes when, once inside the system, you have to make your way, and that’s where other skills come into play, including leadership.

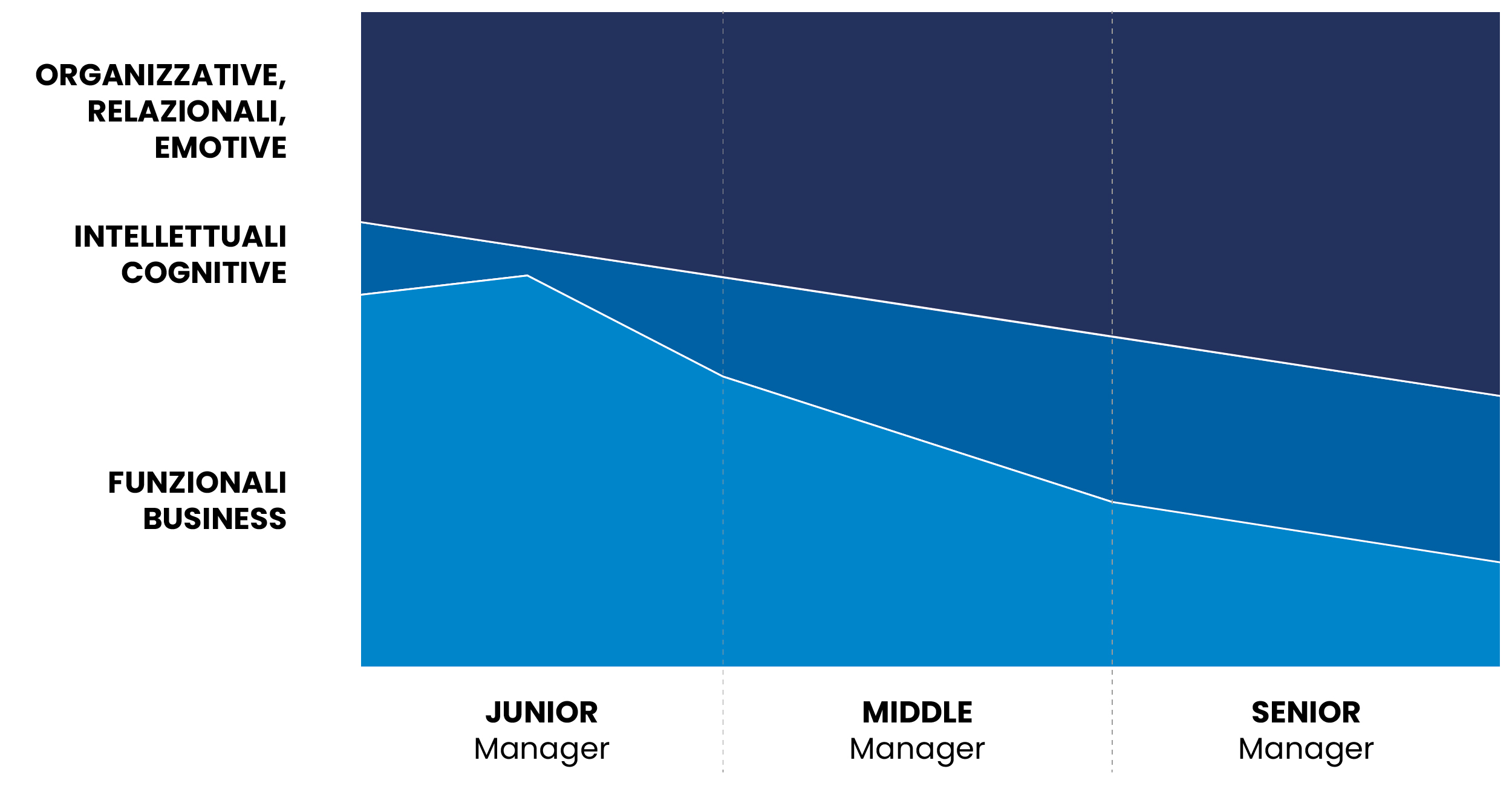

How could we simply define what leadership is? Leadership is the process through which ordinary people achieve extraordinary results. As you can see from the image below, as you progress in your career, from Junior to Senior Manager, fewer technical skills will be required, but more relational and emotional abilities will be.

The relevance of relational and emotional skills for leadership effectiveness.

The first advice is to try to chase your passions. The reason is simple: without passion, the whole process will be more exhausting, and you risk remaining in mediocrity. Alternatively, to accelerate your career, you can decide to focus on sectors with the fastest growth, even if they are not exactly in line with your studies.

I have always been passionate about finance and economic topics

My Journey to Financial Independence

Personally, I started by practicing in an accounting firm, which I quit after a year. In Italy, the field of professional qualifications (accountants, lawyers, etc.) is very long. I believe that in some cases it reaches the pinnacle of exploitation, and often the economic results are far below initial expectations and lower, in proportion, to the sacrifices made. That being said, with a lot of commitment and great determination, even this sector can offer good satisfaction. Both in Italy and abroad, freelance professions still have among the highest average incomes.

Following my passion, I did a Master’s in Banking & Finance which allowed me to enter the banking sector. Even in this case, the experience didn’t last long, because the job was profoundly different from what I had imagined. I can assure you, if needed, that even though I was in the Finance Department of one of the largest banks in Italy, where we operated directly in the financial markets and I dealt with derivatives, it was not exactly like being Gordon Gekko in the movie Wall Street, neither for me nor for my colleagues.

I gave up the “permanent job” to pursue my passions

I noticed firsthand that, in general, salaries in Italy are extremely low compared to the cost of living. This is true both when entering a company and even after many years of hard work, especially in large cities like Rome or Milan where the main opportunities are. Many sacrifices are needed.

Therefore, after these experiences, I understood that the most correct choice to try to achieve financial independence would be to emigrate, and I worked hard to achieve this goal. In the end, with a bit of luck, I succeeded. I started as Chief Financial Officer (CFO) in Africa for an Italian SME in the renewable energy field, and I ended my career about seven years later as the Chief Executive Officer (CEO) of the country.

During this period, I also had the opportunity to attend the EMBA (Executive Master in Business Administration) at SDA Bocconi. I must say that overall I was lucky and things went quite well for me.

Looking Beyond Italy

Emigrating can be brutal, as the late Sergio Marchionne brilliantly explained in his speech at the Rimini Meeting in July 2010.

For me, Sergio Marchionne has always been an important source of inspiration and a leadership model to follow. I confess that although I never had the opportunity to meet him, I miss him a lot. I often wonder how SM would have solved this problem or what he would have done. I can’t help but indulge in a brief digression on his figure: I think Sergio Marchionne was one of the greatest Italian managers of the post-war period and that he was forgotten too quickly. I am sure that one day he will be re-evaluated. As an Italian expatriate, the fact that a small company on the brink of bankruptcy (FIAT) managed to buy a large American company (Chrysler), repaying the debt early, made me prouder than Italy’s victory in the World Cup in Berlin.

Returning to the main topic, if you’ve already had short experiences abroad, such as the Erasmus project, everything will be easier. My first experience as an expatriate student was in New York, before graduating in 2000. There were still the Twin Towers, the internet was not widespread, and prepaid cards did not exist.

Let’s just say it was another geological era, and communication and access to information were expensive and complicated. I worked as a waiter in Manhattan for three months and realized that maybe Italy was not the center of the universe. The world was complex and needed to be explored. I hope my personal experience will provide you with useful insights to maximize your income.

The goal of this first step is precisely to strengthen your Human Capital (step 1), which will consequently allow you to increase your financial income. This way, you are beginning to build the reference model, which will be updated in future articles dedicated to Saving (step 2) and Investments (step 3)

On avance!