Have you ever wondered what your true compensation is? The answer might surprise you.

In the best-selling book The Richest Man in Babylon, author George Clason emphasizes a fundamental principle:

A part of all you earn must be kept

In this article, we will analyze saving from different perspectives. Saving has been defined in many ways. Technically, it represents deferred consumption: I forgo something today to have more tomorrow. Saving can also be defined in terms of flow, as the difference between income and expenses. We can calculate the saving flow or savings rate, which is the key element for achieving financial independence.

The Habit of Saving

Saving, especially at the beginning of your journey, is a good habit that you need to develop. Even if your salary is low at first, try to commit to saving at least 10% of your monthly earnings. This way, when your income increases, it will be easier to manage the money you earn because you will have already consolidated this good practice.

To do this, I suggest thinking of saving as your compensation for the many activities you perform daily. If you share this philosophy, saving will become much easier and less burdensome. By setting aside a portion of what you earn to pay yourself promptly, just as you would with the most deserving of your employees, you’ll find yourself, over time, with a sum of money accumulated effortlessly, though with some sacrifice.

Another good habit you should adopt is tracking all your income and expenses on a spreadsheet. You can create your own spreadsheet or, if you’re lazy, use dedicated apps. This exercise will give you an objective view, and I’m sure surprises will emerge. Nowadays, it’s very simple to track expenses, and this activity will take at most 15 to 20 minutes per week. I do it every Sunday morning, and I can’t go without it—it’s part of my routine.

Calculate Your True Compensation

Before introducing the framework, we need to do a quick exercise that will allow you to determine your true hourly compensation.

Have you ever wondered how much you earn relative to the time you dedicate to work?

For example, if you earn 2,000 euros per month and work 40 hours per week, your compensation is 12.5 euros per hour worked. However, this calculation should also take into account all the monetary expenses associated with your job.

In other words, if you didn’t have that job, what expenses would automatically disappear from your life? For instance, the cost of transportation to the office. For simplicity, let’s imagine you use a car and it takes you thirty minutes each day. Then there’s clothing: are the clothes you wear to work the same as those you wear in your free time, or do you need a separate wardrobe? Additionally, extra meals like after-work drinks, coffee at the bar, and not least, healthcare expenses related to workplace stress. Of course, if you receive benefits, these should be added positively to your hourly wage.

In the end, your true hourly wage will be much lower than the initial 12.5 euros. For simplicity, let’s suppose it’s 5 euros per hour.

Use this figure to ask yourself if it’s really worth spending 200 euros, which equates to 40 hours of hard work, on yet another pair of shoes. Think more in terms of “hours worked” and consider if it’s truly worth it.

The Model for Managing Your Finances

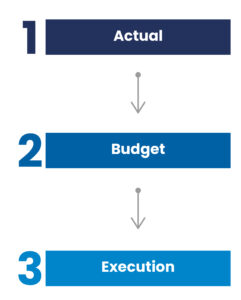

With this premise, let me introduce the model I’ve been using for years to manage my finances. The scheme to follow, represented in the diagram below, is structured in three phases:

- Track expenses and know your current situation — ACTUAL;

- Based on the data, define a PERSONAL BUDGET and outline actions to implement during the year;

- EXECUTION, monitor the results and, if significant discrepancies or unforeseen expenses arise, adjust the budget until it is complete and up to date.

This process should be done periodically. Personally, I create a personal budget every year and, at the end of the year, I prepare a complete report based on the collected data. This is my little tradition for celebrating the new year and starting it with prosperity.

Saving as an Opportunity

We have explored the definition and importance of saving, highlighting how it can be considered a true compensation for yourself.

We also discussed the importance of evaluating your true hourly wage, taking into account all job-related expenses and benefits, to understand how much you actually earn for every hour of work.

Implementing a financial management system that includes expense tracking, defining a personal budget, and constant monitoring is essential for optimizing your savings and maximizing your true compensation. This not only helps you make more conscious spending decisions, but also allows you to better evaluate investment opportunities for your future.

Finally, remember that saving is not just a necessity, but an opportunity to build a solid financial foundation to support your long-term goals. Through careful planning and prudent financial management, you can turn your income into a powerful tool to achieve your dreams.

In the next article, we will continue to explore the stages of our financial management model, providing numerical examples and concrete strategies for each of the three phases.

On avance!