Investing in ETFs might seem simple, but there are several aspects to consider in order to make the right choice and avoid unpleasant surprises. In this beginner’s guide, I’ll explain how to proceed.

In this article, we will explore how to invest in the most important index of global stock markets, the illustrious S&P 500. This index is undoubtedly the most significant on Wall Street, representing the epitome of investment excellence. With its 500 largest U.S. companies, it serves as a guiding star for global investors seeking growth and unmatched opportunities in the stock market.

Part One: Selecting the ETF

Let’s imagine we want to buy an ETF that tracks the S&P 500 index. First of all, you need to know that you cannot directly buy ETFs from the issuing company; you will need a financial intermediary or a broker to carry out the transaction. I have been using Interactive Brokers, for many years. It’s not a beginner’s broker, but with some study, you could use it profitably.

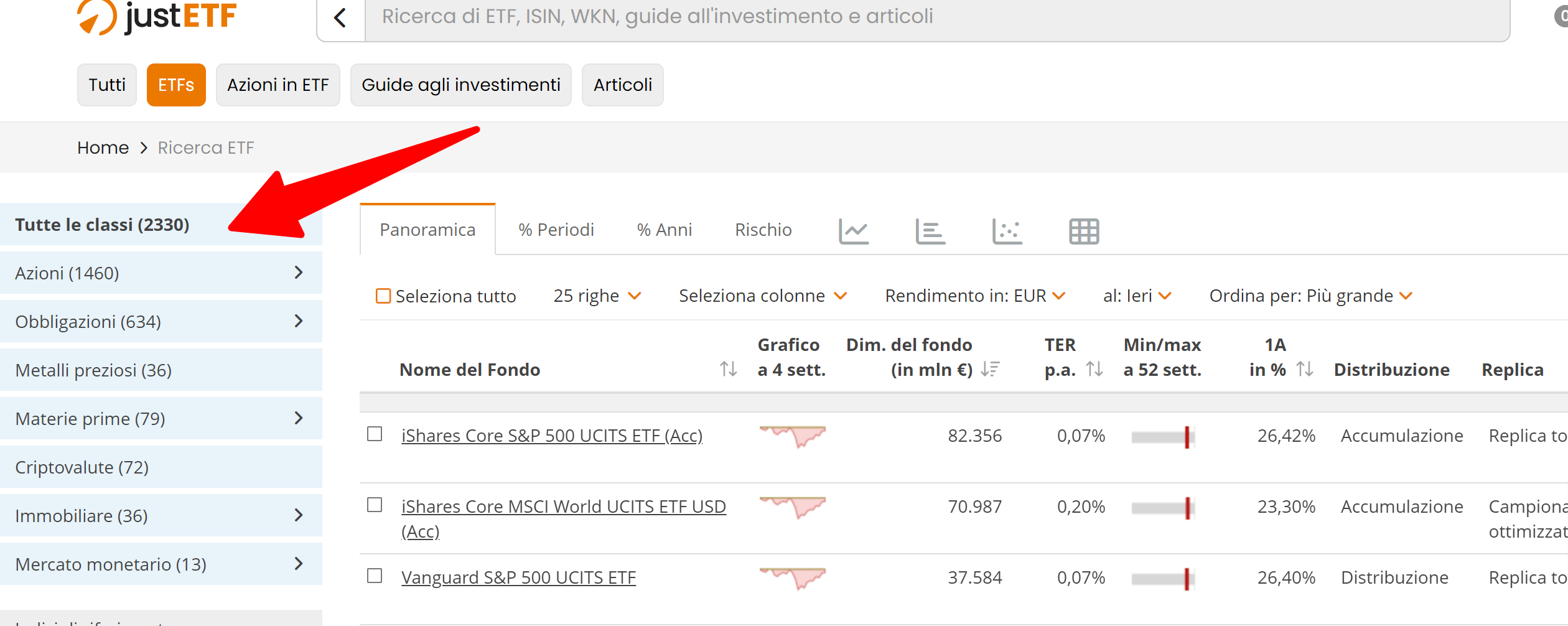

The first step is to quickly identify the product with all the desired characteristics. To do this, you need to get the ISIN code (International Securities Identification Number). This task can be easily done with the help of a screening website, such as www.justetf.com (the free version).

In the top left bar, select “Search ETF” and you will see all available products; at the time of writing this article, there are 2,330 available.

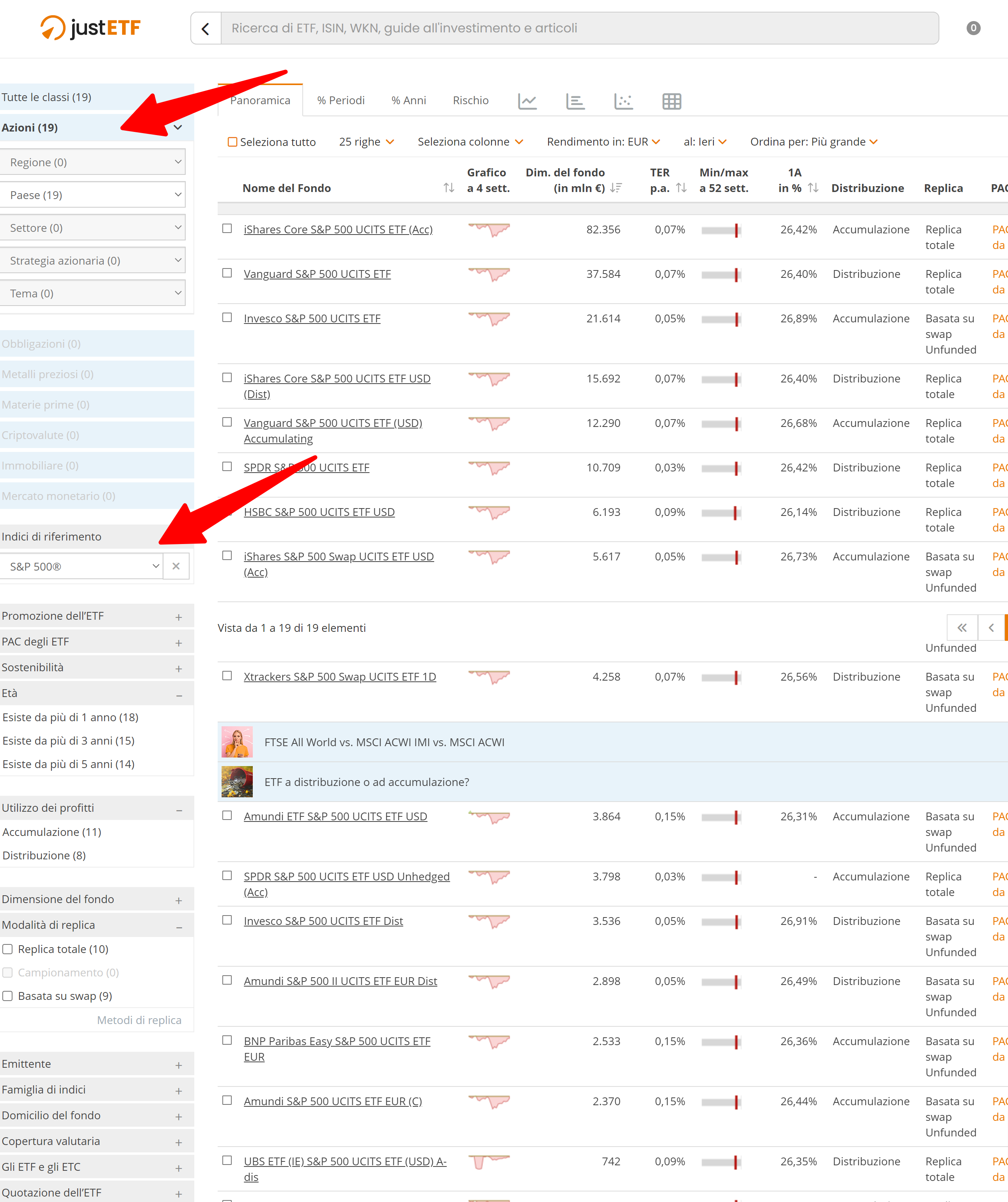

In our case, we are looking for the “best” ETF for the S&P 500. Let’s proceed by using the left-hand menu, selecting “Benchmark Index > S&P 500.” From 2,330 products, we are now down to 19.

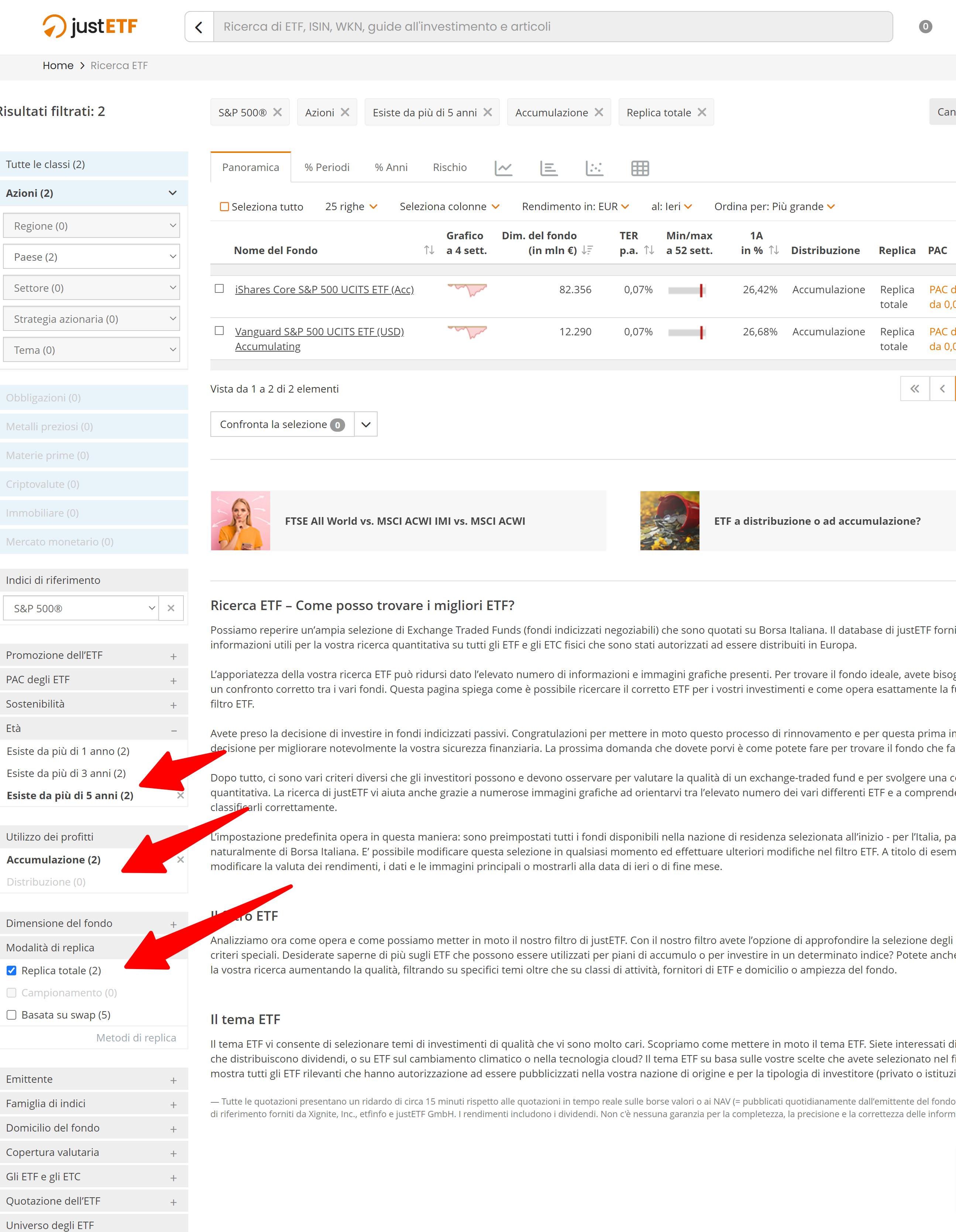

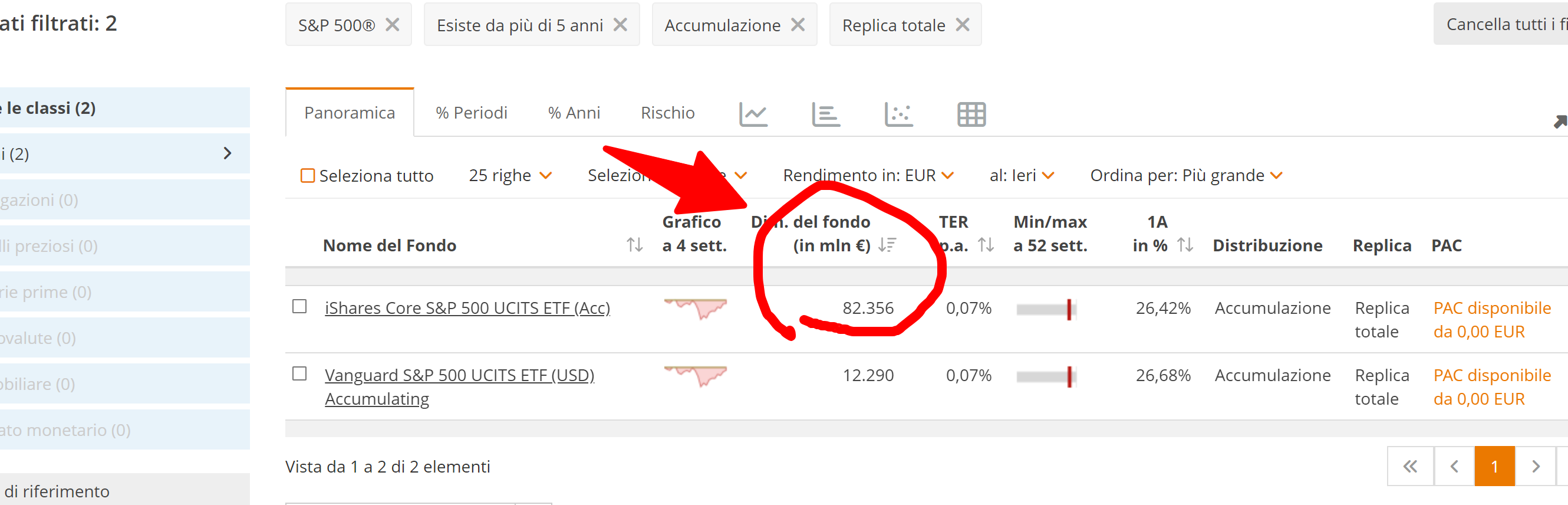

If you’ve read the articles on my blog, you’ll know that investing in ETFs means selecting an instrument that possesses certain specific characteristics: it must be accumulating, physically replicating, and have at least 5 years of history. By applying these filters, we have narrowed down our database to two ETFs

Costs are important, so let’s go directly to the menu and sort the products by fund size. In this example, the costs of the two funds are identical, and both are very large, making them both valid options. However, I prefer the iShares ETF because it has a larger size ($82 billion).

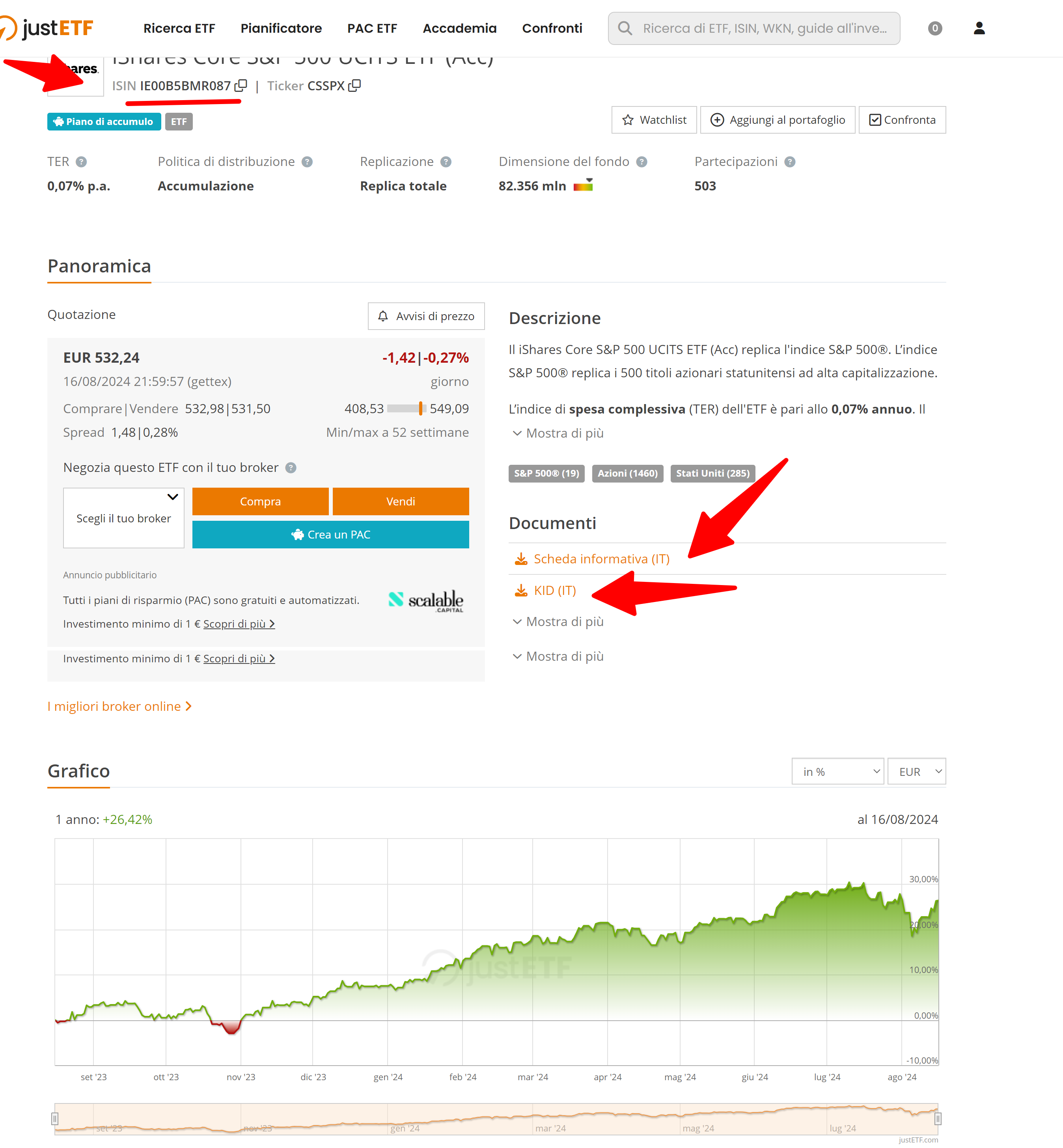

Cliccando sul nome si apre un’altra pagina dove troverai l’ISIN IE00B5BMR087. Oltre al codice, troverai anche la scheda informativa e il KID, documenti che ti consiglio di leggere.

By clicking on the name, another page will open where you will find the ISIN IE00B5BMR087. In addition to the code, you will also find the fact sheet and the KID, documents I recommend you read.

Part Two: Buying the ETF

Once you have the ISIN code, you can proceed with the purchase. I started investing with Fineco and later switched to IB. If you’re just starting out, Fineco is simpler to use.

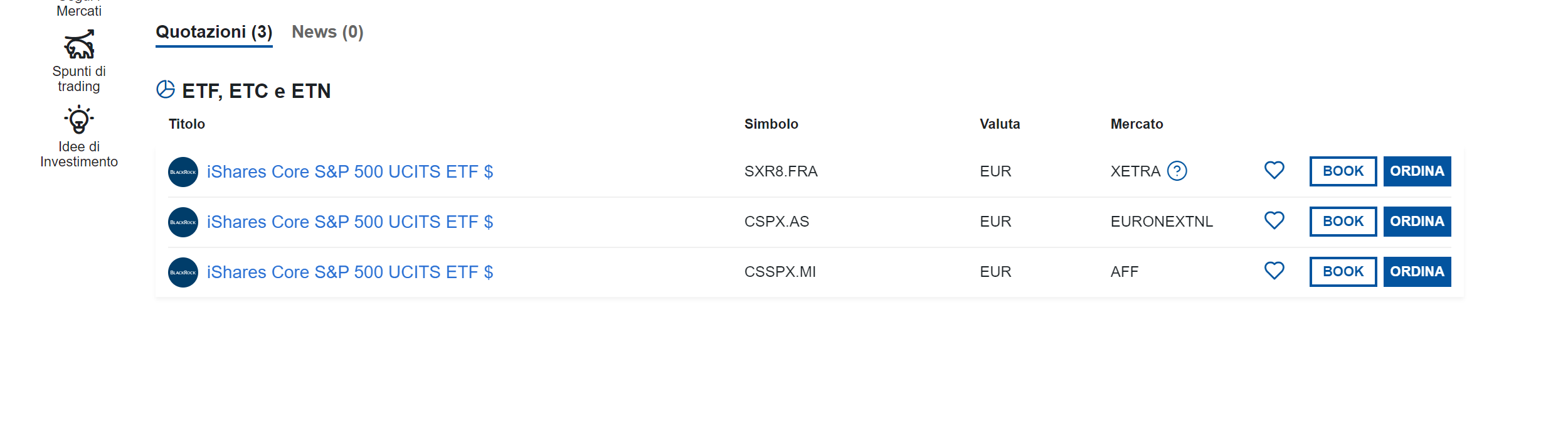

Log in to your account and enter the ISIN in the top bar: three ETFs will appear; choose the one listed in Milan (AFF).

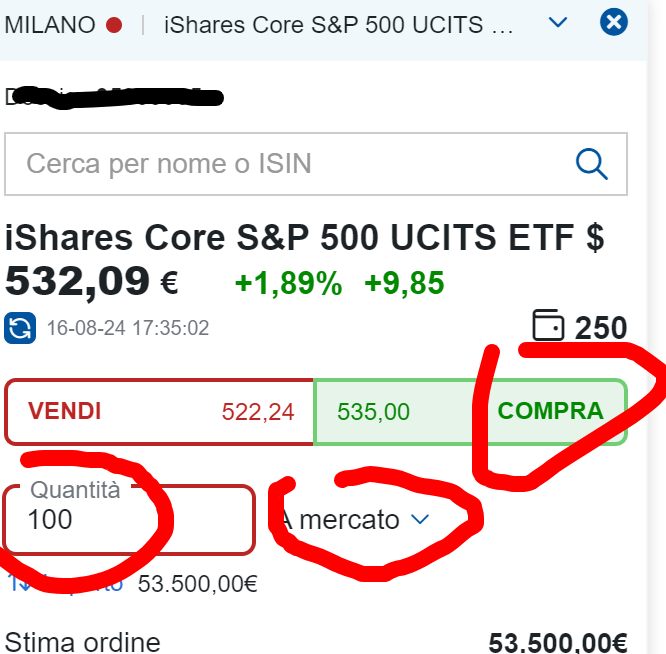

Select “Order.” I recommend making purchases only when Wall Street is open.

Enter the desired quantity, for example, 100 shares. Choose the type of order—it’s always better to place a limit order and set a specific price.

The order will be executed, and the financial product will be added to your portfolio. You’ve now taken your first step in investing in ETFs.

Part Three: The Purchase Strategy

Initially, if your capital is less than €100,000, I recommend automating your purchases on a monthly basis, for example, the first Tuesday of every month, and using the Value Averaging technique.

Set the autopilot and start your journey into the world of ETFs.

Conclusion on Investing in ETFs

Investing in ETFs that track the S&P 500 index is a great way to build your portfolio. However, it is crucial to follow a careful process to ensure error-free execution.

In this short guide, we have explored the essential steps to select and purchase an ETF. From the initial research using the ISIN code, to selecting the best product from those available, to finalizing the purchase through a financial intermediary or broker.

Remember, the key to successful investing is preparation and understanding. Consider automating your purchases if you are starting with less than €100,000. This approach will allow you to benefit from the growth of the S&P 500 market with less stress.

With this information, you are now ready to make informed decisions and embark on your ETF investment journey with prosperity.

On avance!

Disclaimer: This article is for educational and informational purposes only. It is designed to help you make informed decisions and develop critical thinking in all areas, using concrete examples. The final investment decisions remain your personal responsibility.