Hilton is one of my favorite hotel chains. Every time I stay at one of their properties, I almost feel at home. As of December 31, 2023, the group owns a portfolio of 7,530 properties, with 1,182,937 rooms across 118 countries. Hilton Worldwide is listed on the New York Stock Exchange (NYSE) under the ticker HLT. You can easily buy the company’s shares on the stock market through a financial intermediary; I’ve been using Interactive Brokers for many years.

The Hilton Honors Program

Like all major hotel chains, Hilton offers a loyalty program, Hilton Honors, of which I’ve been a member since 2010. The program has different status levels: Silver, Gold, and Diamond. The status, especially the Diamond one, can make your stay truly memorable.

To obtain the desired status, in addition to stays, you can take advantage of credit cards, although for the Italian market, only American Express is currently available, and not the Hilton-branded cards. Hopefully, these will return soon. If you want more information on how to optimize point collection, the best site in Italy is The Flight Club.

However, unlike Accor, which has a specific program for small shareholders, Hilton only offers an Owners Programme that guarantees Diamond status. Buying a hotel to get this status might seem a bit excessive, don’t you think?

Among the many hotels I’ve stayed at, my favorite is the Waldorf Astoria in Beijing, and in another article, I’ll tell you why

A Free Week as a Shareholder

Have you ever wondered how many dividends would be needed to cover the cost of a week-long vacation?

For simplicity, I’ve estimated the value of a stay at $1,500. This year, Hilton will pay a dividend of $0.15 per quarter, or $0.60 annually, with a yield of 0.28%. At first glance, this yield might seem low for the sector; so let’s understand why.

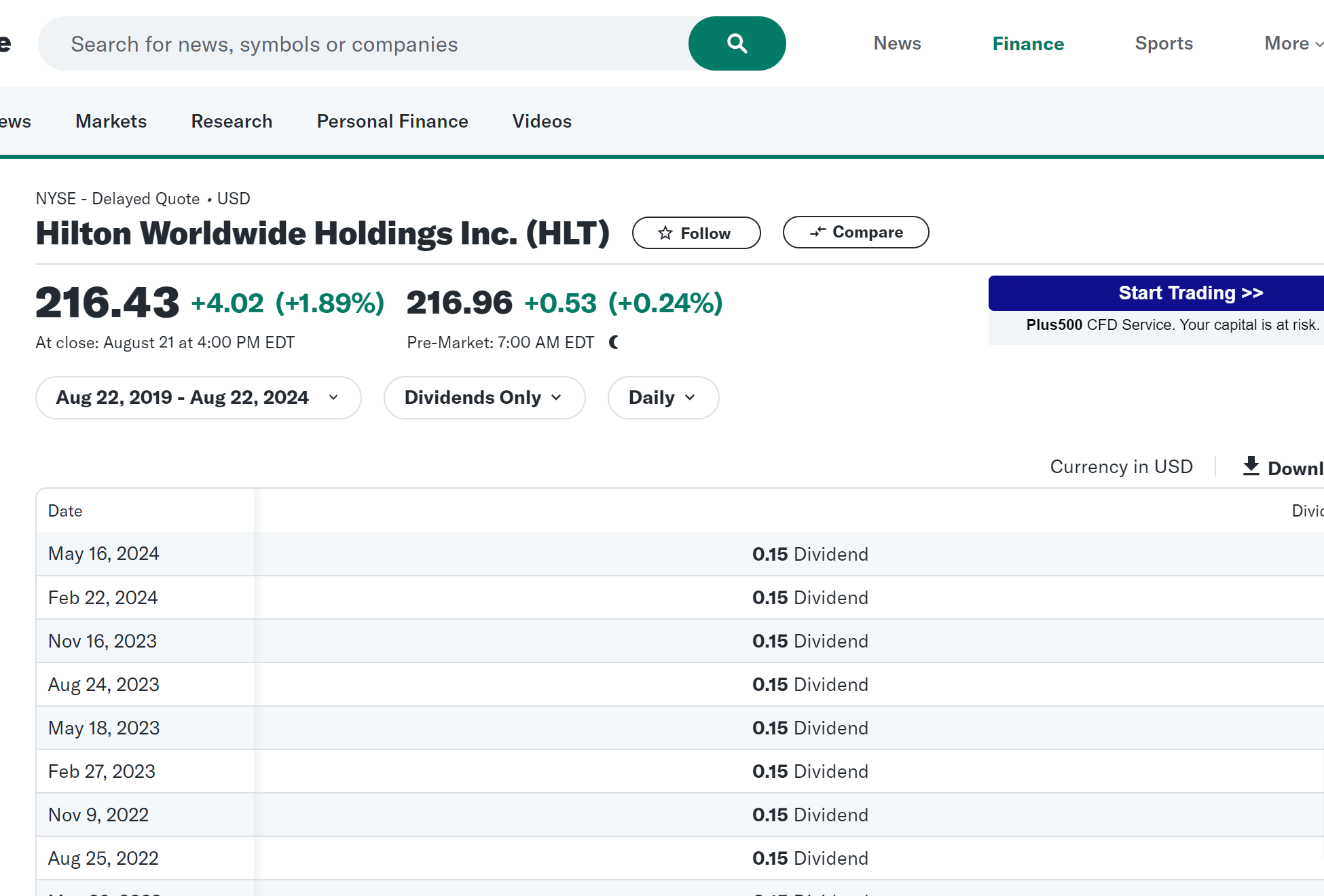

Here is a table with the dividends distributed over the last five years:

So, is Hilton a good investment to transition from consumer to shareholder?

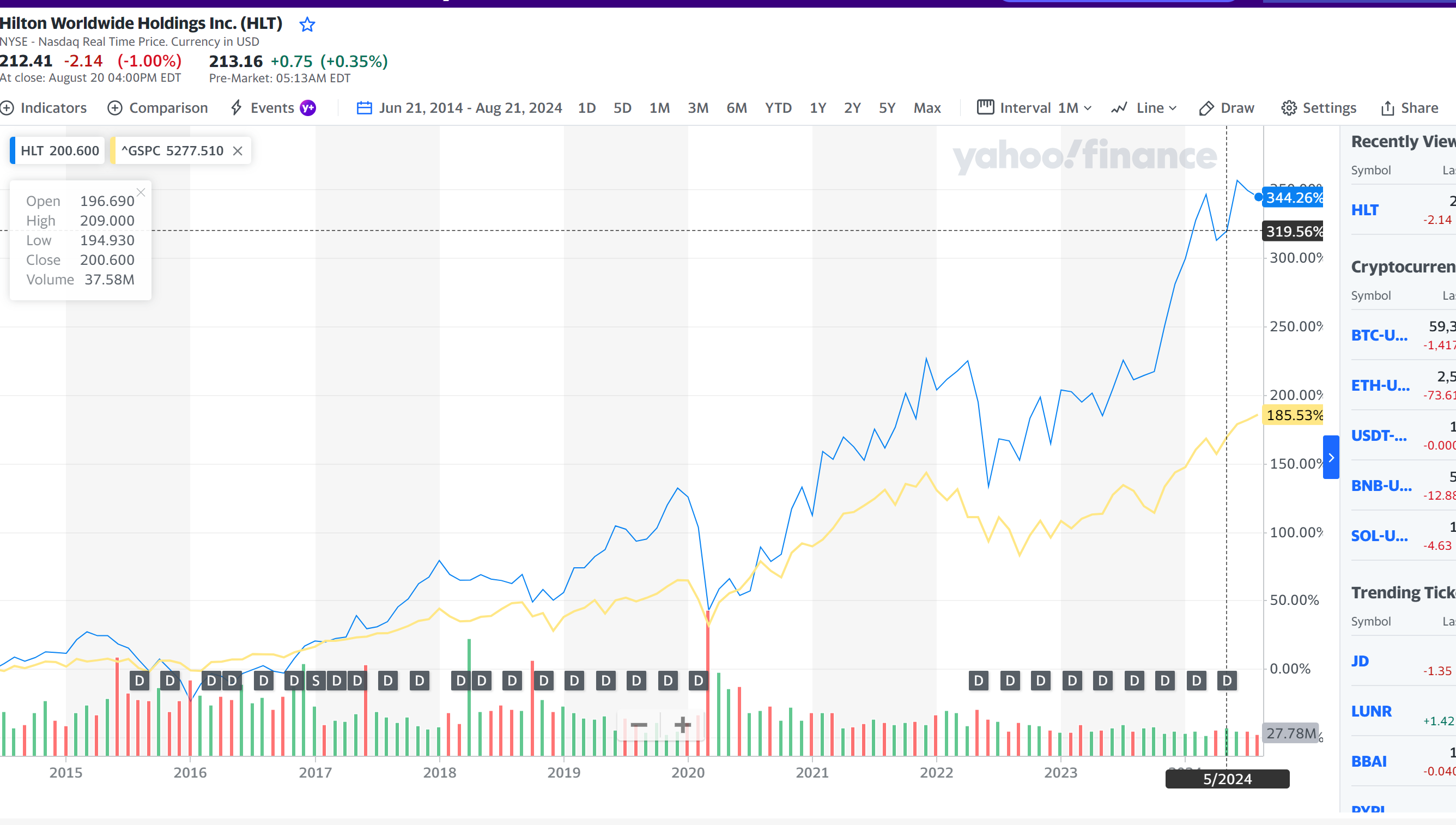

Let’s analyze the stock’s performance over the last ten years: of course, past returns do not guarantee future ones, but we can compare it with our usual benchmark to assess the opportunity cost.

In this case, the numbers speak for themselves: Hilton has consistently outperformed the benchmark, with a 344% growth compared to 185% for the S&P 500, not including dividends.

If you had invested $100,000 in 2014, today you would have $344,000, compared to $185,000 with the S&P 500. Although Hilton doesn’t pay generous dividends, the stock’s growth has been significant.

To cover your vacation expenses, you would have had to sell some shares. But with those gains, you could afford luxury vacations without worries. In fact, going back to the example of $100,000 invested in 2014, today that amount would be about $344,000, and you’d only need to sell 0.5% of the entire investment to pay for your vacation week.

Here’s another interesting point. With $100,000 invested 10 years ago, now worth $344,000, you have effectively gained $244,000 (excluding taxes for simplicity). If your vacation week costs $1,500, with just the profits (and therefore, essentially for “free”), you could afford about 162 weeks of vacation. More than 3 years!

Investing in this Company

In summary, Hilton represents an interesting investment, especially when considering its performance against the S&P 500 and the significant stock growth over the past ten years. The company does not pay generous dividends, preferring to reinvest profits into growth and development. This approach often translates into strong stock value growth over the long term.

In general, companies that do not pay dividends tend to grow more because they reinvest profits to expand operations, innovate, and seize new market opportunities. Of course, these companies should be examined more carefully, as the lack of dividends could also indicate low profits that do not allow generous shareholder remuneration. This hasn’t been the case with Hilton, but it’s important to exercise caution.

If your goal is to achieve significant returns through capital growth rather than dividends, companies like Hilton might offer you greater growth potential. However, it’s important to align your choices with your investment goals, risk tolerance, and proper portfolio diversification.

One essential aspect to consider is diversification: an investment in a single stock should never exceed 5% of your overall portfolio. Never put all your eggs in one basket – this is a fundamental principle in building your investment portfolio.

On avance!

Disclaimer: This article is for educational and informational purposes. It aims to help you make informed decisions and develop critical thinking in every area through concrete examples. The final investment decisions remain your personal responsibility.