Traveling in business class is a privilege, especially on long-haul flights. You can purchase your airline ticket directly from the airline’s website, or look for other options to do so without spending a fortune. For example, you could use miles accumulated from previous trips, turn your credit card spending into miles, or combine both strategies. The possibilities are numerous, and there are specialized sites that offer advice on how to optimize these strategies; in Italy, for instance, the best one is The Flight Club.

The topics covered on my blog revolve around investments and personal finance, so I’d like to analyze this issue from a different perspective, more consistent with the spirit of The Finance Club.

The major airlines are publicly traded companies, and we can easily purchase their shares through a financial intermediary; I’ve been using Interactive Brokers. for many years. Based on their industrial plans, it’s possible to make accurate forecasts of expected dividends in the coming years. Dividends represent an important component of stock investments, especially for stable sectors like energy, telecommunications, and finance.

Wouldn’t it be fantastic to travel using dividends, turning ourselves from consumers into shareholders?

Singapore Airlines Business Class

My favorite airline is Singapore Airlines. Recently, I had the good fortune to fly their A380 in Business Class from Singapore to Frankfurt, and I must confess that the experience was memorable.

Singapore Airlines (SQ) is one of the largest airlines in the world and is often rated one of the best in the industry. From its hub at Singapore-Changi Airport (SIN), it operates flights to over 60 destinations in 35 countries across six continents. Its current fleet consists of 155 aircraft. In 2023, Skytrax awarded the airline the title of “best in the world” at the prestigious World Airlines Awards.

For simplicity, I’ve estimated the cost of a business class ticket for a long-haul flight at €3,000, equivalent to S$4,367 (at an exchange rate of 1.46). The Singapore Airlines stock, listed on the Singapore Stock Exchange (ticker C6L.SI), is currently priced at S$6.20 per share. The dividend distributed is S$0.38 per share, with a forecast increase to S$0.48, yielding 7.86%.

From Consumer to Shareholder

To cover the cost of a business class ticket with dividends, you would need 11,492 shares, corresponding to an investment of S$71,250, or about €48,944. I wonder if this could be a good investment, considering the generous dividend yield of 7.8%.

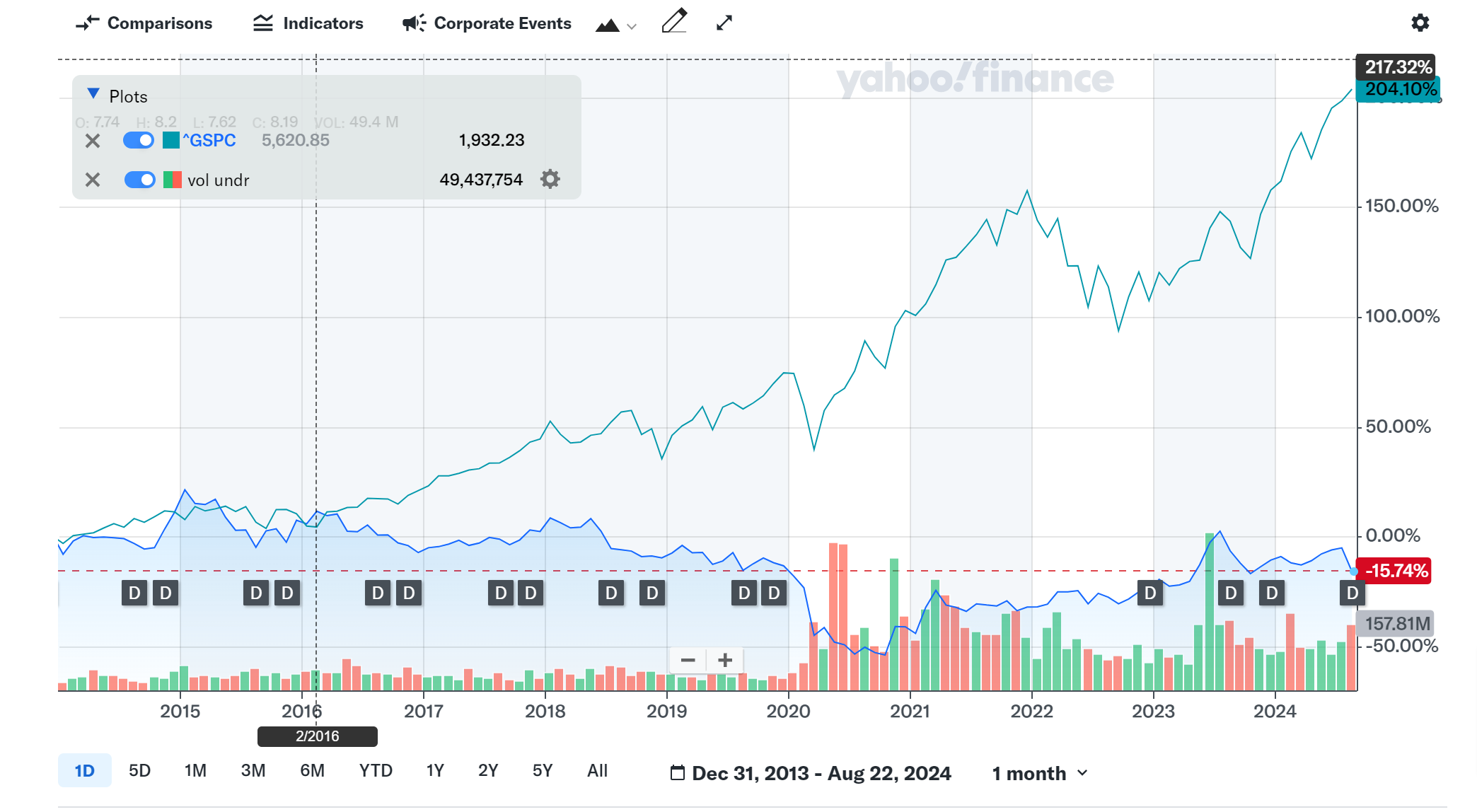

First, it’s important to assess the historical performance of the stock. Of course, past returns don’t guarantee future performance, but we’ll compare it with my reference benchmark, the S&P 500, to evaluate the opportunity cost.

Performance Over the Last Ten Years

Over the past ten years (since January 2014), the S&P 500 has grown by over 200%, while Singapore Airlines has seen a loss of 15%. Despite generous dividends, the investment hasn’t performed as well as the benchmark.

The airline industry is complex, and few companies manage to be profitable in the long term. Historically, less than 40% of global airlines have been consistently profitable, a percentage that drops further during economic crises or extraordinary events.

The Key to Investing

The key to investing isn’t to evaluate how much an industry can change society or how much it’s destined to grow, but to determine the competitive advantage of each company and, most importantly, the duration of that advantage.

The Most Striking Cases in the Airline Industry

One of the most striking success stories in the airline industry, studied in business school worldwide, is Southwest Airlines. The company thrived thanks to a low-cost model, a homogeneous fleet, a strong corporate culture, and a prudent expansion strategy. In contrast, Pan American World Airways, once considered the best airline in the world, went bankrupt in 1991 due to intense competition, financial and managerial problems, and the devastating impact of the Lockerbie bombing.

For a more complete picture, you can use Porter’s Five Forces model, which helps us better understand these dynamics by analyzing the competitiveness of an industry through threats like new competitors, supplier and customer power, substitute products, and rivalry among competitors. These factors explain many of the difficulties in the airline industry.

Porter five forces model strategy framework

It is important to be cautious when investing in companies that distribute generous dividends, such as Singapore Airlines with its 7% yield. Over the long term, these companies tend not to grow enough to outperform the market.

Dividends vs. Company Growth

Paying dividends represents a portion of a company’s capital distributed to shareholders. This may seem like an immediate benefit for those receiving it the feeling of getting a transfer every quarter to your bank account is quite pleasant. On the other hand, you must consider that these distributions reduce the resources available for other investments and, in extreme cases, may even lead the company into debt.

No Free Lunches on Wall Street

Consequently, while dividends provide a stable income stream, they could hinder the company’s growth in the long run, reducing the stock’s appreciation potential. Therefore, while dividends can be part of a diversified investment strategy, it’s wise not to rely solely on this type of stock.

I believe that these types of stocks, particularly those in the aviation industry, fall more into the “funny money” category and shouldn’t exceed 5% of your portfolio.

Next Articles

In the next articles, I’ll explore the Delta Airlines case. We’ll find out if the American company can outperform the benchmark and whether it’s possible to fly business class with dividends or if this remains a mere utopia.

On avance!

Disclaimer: The purpose of this series of articles is purely educational and informational. The articles are focused on how to make decisions consciously and how to sharpen critical thinking in every area, using concrete examples. Final investment decisions are a personal and individual responsibility.