Traveling in business class might be more affordable than one might imagine. They say that you never forget your first love, and Delta Airlines holds a special place in my heart because it was with them that I flew business class for the first time in my life. I vividly remember that experience: at the time, I was a young, broke professional who frequently traveled to New York for work, always strictly in economy class. Unfortunately, The Flight Club. website didn’t exist back then.

At that time, I had Ulisse status with Alitalia, and that evening in 2007 gave me a pleasant surprise. I’m not sure why, but just as I was about to board my flight from New York to Rome, my boarding pass was changed at the gate. When they wrote “3D,” I didn’t immediately realize what was happening, but once on board, I unexpectedly found myself in the business class cabin. I will always remember that journey, and I still keep the boarding pass.

Who is Delta Air Lines?

Delta Air Lines, commonly known as Delta, is an American airline headquartered in Atlanta. The company operates over 5,400 flights a day and serves more than 300 destinations in 52 countries across six continents. Delta is a founding member of the SkyTeam alliance. Today, the airline operates a fleet of 433 Airbus aircraft, and last year it carried 190 million passengers.

Currently, Delta does not offer any additional perks, such as discounts or status, to its shareholders. I wonder: how many dividends would it take to fly business class with this airline and transition from a consumer to a shareholder?

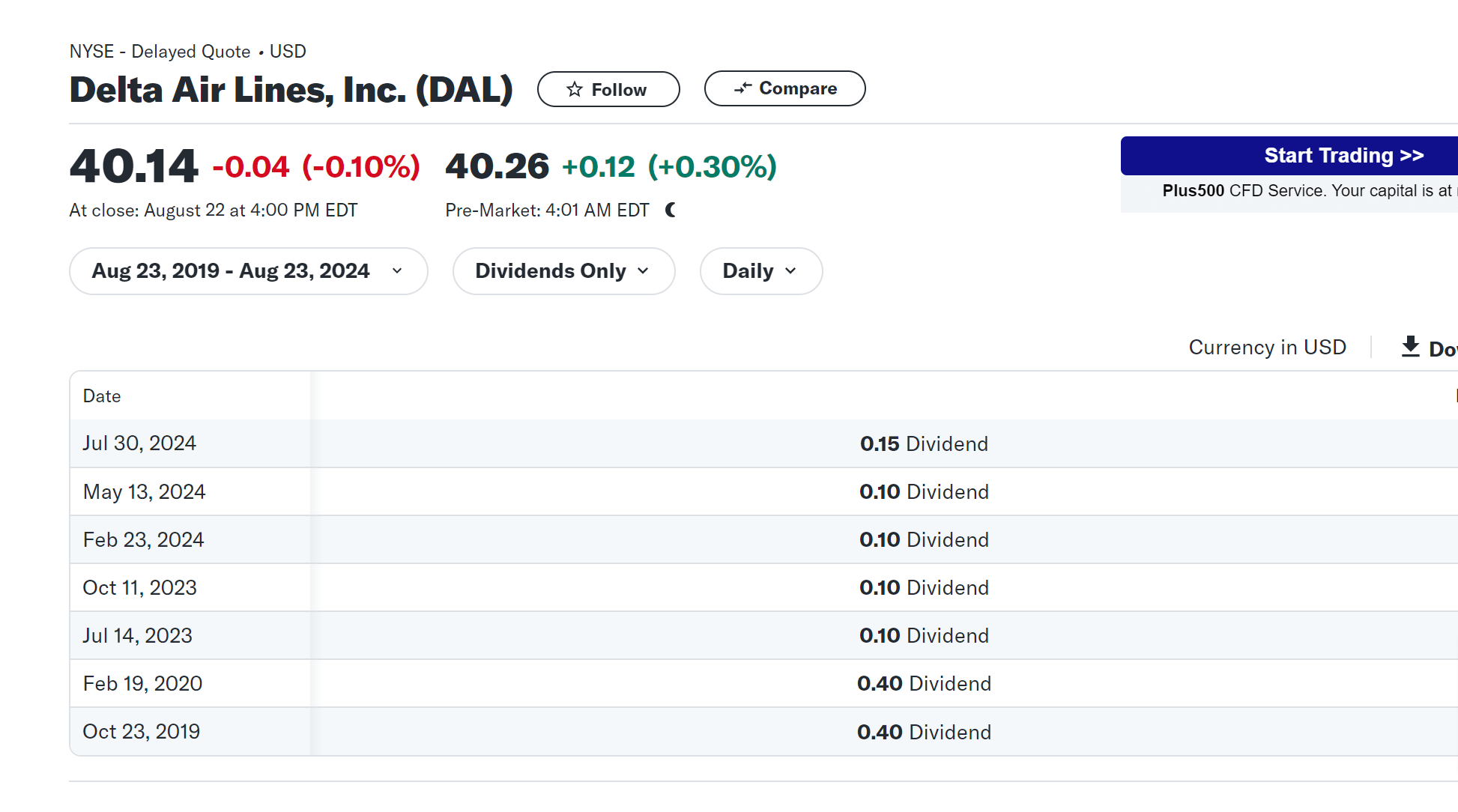

Let’s assume the cost of the airline ticket is $3,000. The current annual dividend is $0.60, corresponding to a yield of 1.49%. To receive the desired amount in dividends, I would need to own 5,000 shares. The company, except during the COVID-19 pandemic, has always distributed dividends. Below is a table showing the dividends distributed over the last five years:

Delta Air Lines is listed on the NYSE under the ticker DAL. As I write this article, the stock is priced at $40.14 per share. If you want more information about the stock’s performance or wish to buy shares, you can use a broker or financial intermediary; I have successfully used Interactive Brokers. for many years.

Currently, the required investment would be $200,700, an extremely high amount for a single stock.

Never put all your eggs in one basket

The Comparison with the S&P 500 Over the Last Ten Years

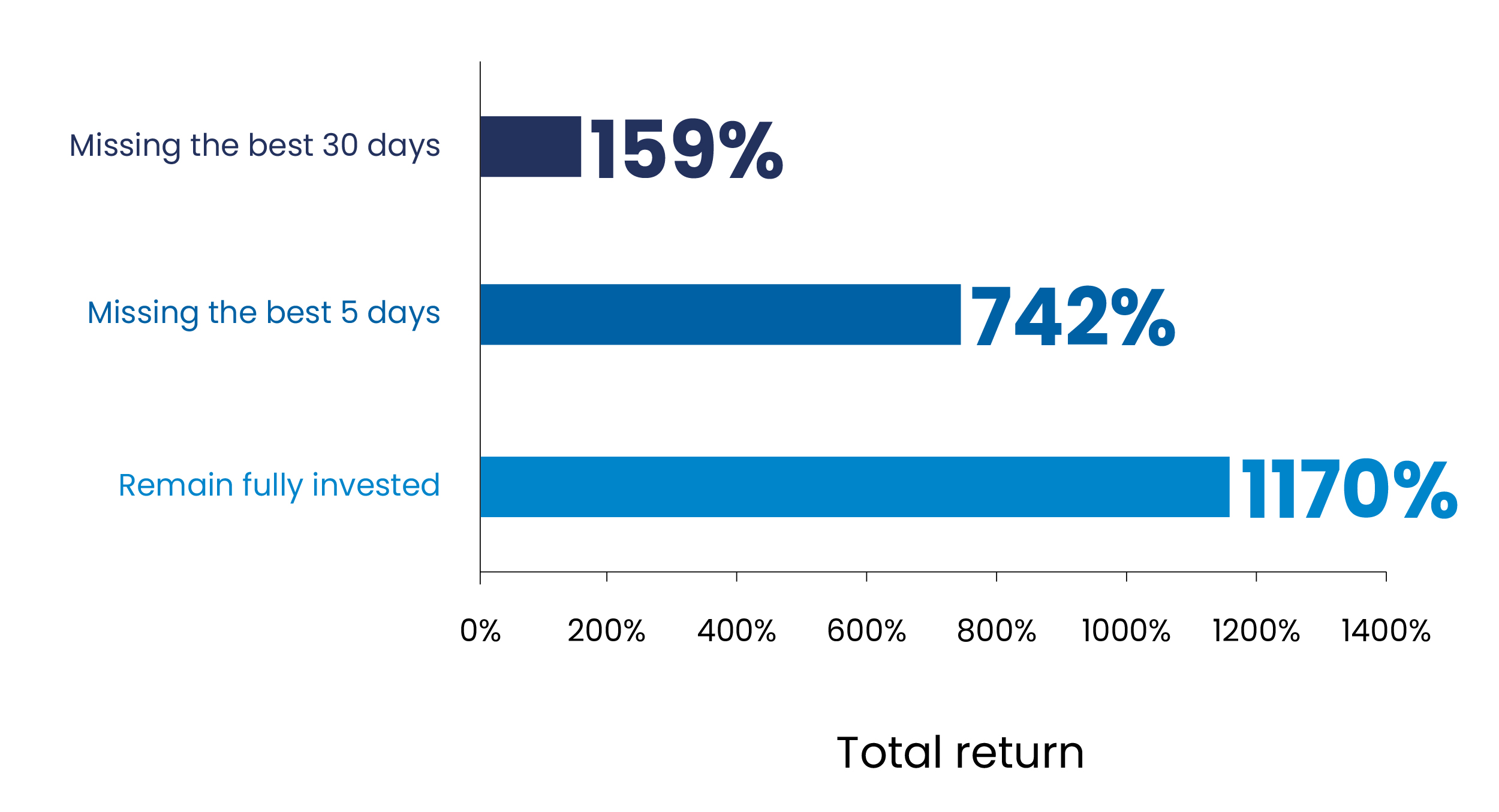

Let’s examine the opportunity cost and compare the stock with our usual benchmark, the S&P 500. How has the stock performed over the past ten years?

The stock has grown by 46.12%, while the S&P 500 has increased by 204%. Therefore, the index has significantly outperformed the stock over the long term.

However, what I find interesting is that, before the COVID-19 pandemic, from 2014 to 2020, Delta consistently outperformed the index. For small investors like us, market timing is extremely difficult and not advisable, as making the wrong choice can make a big difference in long-term returns.

Why?

Why?

Clearly, there is no single cause; the factors are numerous and interconnected.

At the macroeconomic level, before the pandemic, the airline sector was experiencing a strong growth phase, driven by the increase in business and leisure travel globally. Delta benefited from this expansion, managing to increase its capacity and add new routes, especially internationally. However, this factor alone is not enough, as only 40% of airlines are profitable in the long term.

Delta Air Lines’ Strategy

Delta has been considered one of the most efficient and well-managed airlines in the United States. It has invested in new technologies and a modern fleet, improving its operating margins. This ability to keep costs under control, combined with a focus on the customer experience, contributed to its profitability. Additionally, the company capitalized on its SkyMiles loyalty program and credit card agreements, generating a significant source of extra revenue.

Instead of distributing generous dividends, management chose to reduce debt and repurchase its own shares (buybacks), which positively impacted the stock price. These policies strengthened investor confidence, leading to stock appreciation.

All of this led to improved financial fundamentals, with solid revenue and profit growth, thanks to a combination of fare increases, cost control, and a growing U.S. economy. Even Warren Buffet has invested in this company; with this example, I have nothing more to add

Conclusion

Flying in business class exclusively with dividends may require too large of an investment. The volatility of the airline sector and the comparison with the benchmark show us that, in the long term, investing in passive indexes can offer higher returns and lower risks compared to individual stocks like Delta Airlines.

Passive indexes are much more boring compared to investing in an airline stock. I believe that this type of stock falls more into the “funny money” category and should not exceed 5% of your portfolio.

On avance!

Disclaimer: Lo scopo di questa serie di articoli è puramente educativo ed informativo. Gli articoli sono focalizzati su come prendere decisioni in modo consapevole e su come affinare il pensiero critico in ogni ambito, utilizzando esempi concreti. Le decisioni finali riguardanti gli investimenti sono una responsabilità personale e individuale.