Every time I travel for work, I have a little ritual: I always buy a Hermès tie at the airport. Over the years, my collection has grown. I’m not exactly sure why, but this habit makes me feel good, and I keep doing it, even though I already own quite a few. Wearing one of those ties and walking around with the signature Hermès orange bag creates a kind of addiction.

Hermès is not only famous for its ties but also for one of the most iconic luxury goods in the world: the Birkin bag, available in various versions, from the more compact Birkin 25 to the rare and highly coveted Himalayan Birkin. This bag, beyond being a fashion accessory, has become a true status symbol over time, captivating many women, some of whom have become obsessed with it.

What makes the Birkin so special?

Perhaps the answer lies in its exclusivity. Hermès produces only 12,000 pieces annually, while the demand is estimated to be at least three times higher. The French fashion house maintains an air of mystery around production numbers, which can vary from year to year. The limited production is a calculated strategy to maintain the exclusivity and value of the Birkins, turning each bag into a sought-after and rare item.

However, we all know that the price of a good is determined by the balance between supply and demand. Keeping production below demand certainly helps sustain the price, but that alone doesn’t fully explain the Birkin phenomenon. The natural consequence of this scarcity is long waiting lists, which can reach up to six years for some models. Not everyone is willing to wait, especially when they are wealthy or looking to impress someone. This is where a thriving parallel market comes into play, fueled by so-called ‘resellers.’ This phenomenon is not limited to Hermès’ Birkin but also includes other luxury goods like Patek Philippe’s iconic Nautilus watch or Rolex’s Daytona

The Birkin Bag: Not Just a Matter of Scarcity

Scarcity alone isn’t enough to make a Birkin so desirable. It also requires craftsmanship and the intrinsic quality of the product. Each Birkin is handcrafted by highly skilled artisans who dedicate hours of meticulous work to each bag. The quality of the materials used, ranging from calfskin to crocodile or ostrich, combined with attention to detail, ensures that these bags are not only aesthetically perfect but also extremely durable.

Producing a Hermès Birkin bag requires extremely detailed and complex work. Each bag is crafted entirely by hand by a single artisan, who can take between 18 and 25 hours to complete one. This time can vary based on the complexity of the model, the materials used, and any personalized details requested by the customer. Personally, I’ve owned a simple Hermès belt for nearly ten years, and I can assure you it still looks brand new, as if I bought it yesterday. This level of quality is one of the aspects that makes a Birkin a safe investment.

Another key factor is the brand’s value and historical legacy. Hermès is synonymous with luxury and tradition, with a history dating back to 1837. Over time, the brand has built an identity that associates its name with craftsmanship and exclusivity. Owning a Birkin isn’t just about buying a bag; it’s about becoming part of this legacy, owning a piece of history.

Finally, it’s impossible to ignore the status associated with the Birkin. It’s not just a fashion accessory but a symbol of success and wealth, amplified by its association with celebrities and high-profile figures. Hermès doesn’t need traditional advertising for the Birkin; the rarity and limited access create natural demand, fueled by word-of-mouth and public admiration.

The Numbers Behind Hermès

This strategy isn’t easy to execute, and that’s what makes Hermès’ story so fascinating. Unlike other luxury companies like Patek Philippe, Hermès is not a private company but a publicly traded one, with the ticker ticker RMS.PA on the Paris Stock Exchange.

As I write this article, the company has 23,000 employees and a market capitalization of €233 billion. Being publicly listed offers advantages, like the ability to grow quickly, but it also introduces pressures tied to quarterly results, making it even more challenging to implement these strategies.

All of this raises an interesting question: Is it more advantageous to be a passionate consumer or a long-term shareholder?

The Big Dilemma

The great dilemma for an investor is deciding whether it’s more worthwhile to buy the most iconic Birkin or invest in the company’s stock. This is a question worth pondering, considering not only the resale value of the bag but also the financial potential of Hermès as a publicly traded company.

I remember a few years ago when my colleagues and I received a bonus that I invested entirely in an ETF on the S&P 500 for my accumulation plan. At the time, I was in the accumulation phase, and every single penny was directed towards investments. There were periods when I managed to save up to 70% of my salary; today, I wonder how I managed to do that. I think I was in a state of “flow.” On that occasion, I accompanied a colleague to Hong Kong, where he was searching for a Birkin for his wife to celebrate his bonus. It was a classic case of the “Diderot effect”. The bag cost around €25,000, and that’s when I discovered this completely new world for me.

A Birkin or Its Equivalent in Stock?

But what would have happened if my colleague had bought shares in the company or a simple ETF and given his wife a more modest gift?

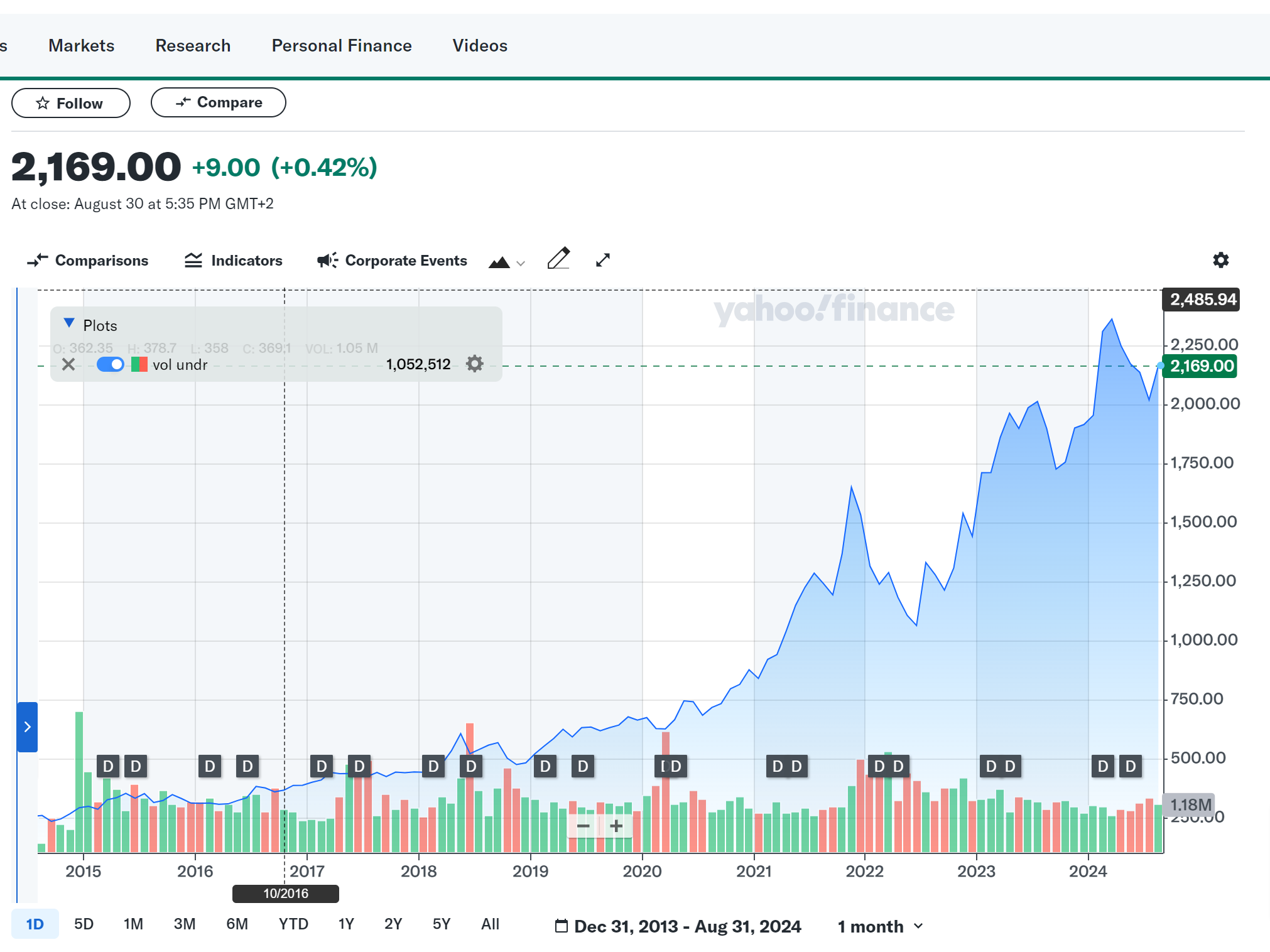

At the time, with €25,000, he could have purchased 104 Hermès shares, which were then priced at €239 each. As I write this article, those shares are worth €2,169 each, meaning that if he had held the shares for ten years, they would now be worth €225,576. Today, with the value of those shares, he could have bought an apartment. In life, some decisions are crucial and can have a massive impact on our future

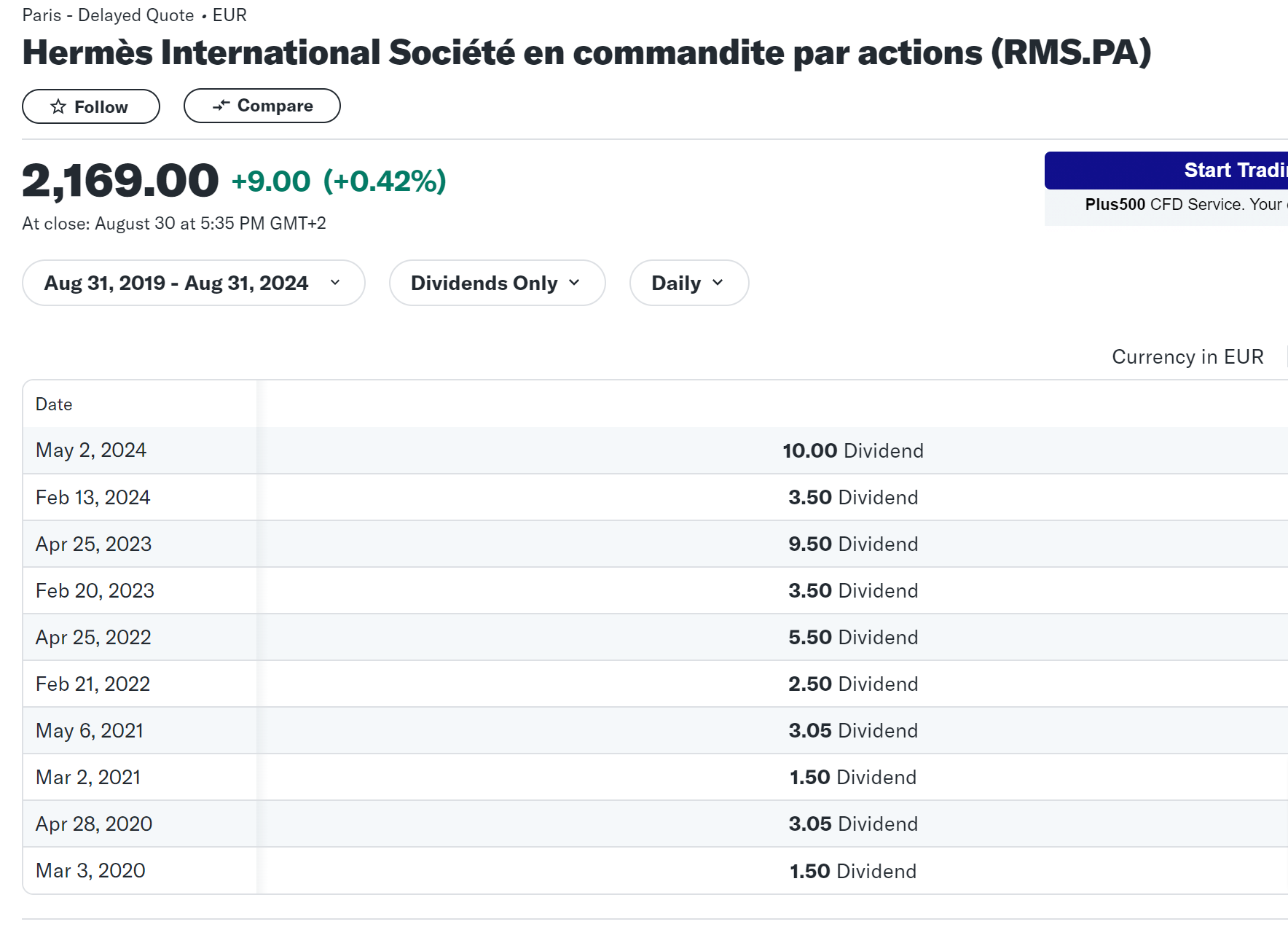

Beyond the capital appreciation, he would also have benefited from dividends. The last dividend was €10 per share, totaling €1,040, and the next one will be €15 per share. Here are the last five years: as you can see from the table, the company has consistently distributed dividends. Over the period analyzed, these dividends amount to an additional €7,378, which, when added to the €225,576, brings the total investment value to €232,954.

We’re left to evaluate the opportunity cost and compare the stock’s performance to the usual benchmark, represented by the S&P 500. Hermès is one of the rare cases where it has consistently outperformed the index over the past ten years, and by a significant margin.

Hermès undoubtedly represents an extraordinary success story, both as a company and as an investment. The data over the last ten years shows that purchasing Hermès stock could have led to exceptional gains of +723%, outperforming the S&P 500 (+205%) by three and a half times.

Some Final Thoughts

However, it’s important to remember that no financial investment should be made in isolation. Diversification remains one of the golden rules of investing—never put all your eggs in one basket.

Reducing risk by not concentrating too much capital on a single stock or asset class is essential to protecting your wealth from market uncertainties and volatility.

Beyond the purely financial aspects, it’s also important to reflect on the comparison between owning a luxury good and investing in financial instruments. Buying a Birkin bag can offer immediate personal satisfaction, a tangible pleasure, and a status symbol. However, every financial choice comes with an opportunity cost: the money spent on a luxury good could be invested differently, potentially generating greater value over the long term.

In this context, balancing personal satisfaction with smart financial decisions becomes crucial. The decision between buying a luxury item or investing in stocks or other assets must take into account long-term goals and individual priorities. Additionally, it’s prudent to remember that investment in a luxury item, like a Birkin bag or a Patek Philippe watch, should never exceed 5% of your wealth. This approach helps maintain healthy financial balance and reduce the risks associated with significant expenditures on non-liquid assets.

On avance!

P.S. My colleague eventually got divorced… I wonder what happened to the Birkin bag.

Disclaimer: This article is for educational and informational purposes only. It aims to help you make informed decisions and develop critical thinking in every area through concrete examples. The final investment decisions remain your personal responsibility.