Can luxury watches be considered an investment? In this article, we will explore this question from a different perspective, and the answer might surprise you.

We’ve already discussed the main investment classes:

- Stocks

- Bonds

- Gold

- Commodities

- Real Estate Investment Trusts (REIT)

- Cash in currency

To this list, we could add another category: alternative investments in real assets, such as luxury watches.

If done correctly, this type of investment can diversify your portfolio, protect it from inflation, and reduce its volatility. In theory, it should serve the same function as gold or real estate, but with a few additional advantages.

When to Buy Luxury Watches

As we’ve learned, there are no free lunches on Wall Street, and luxury watches come at a price. The long-term growth of your capital will most likely be lower than that of the S&P 500.

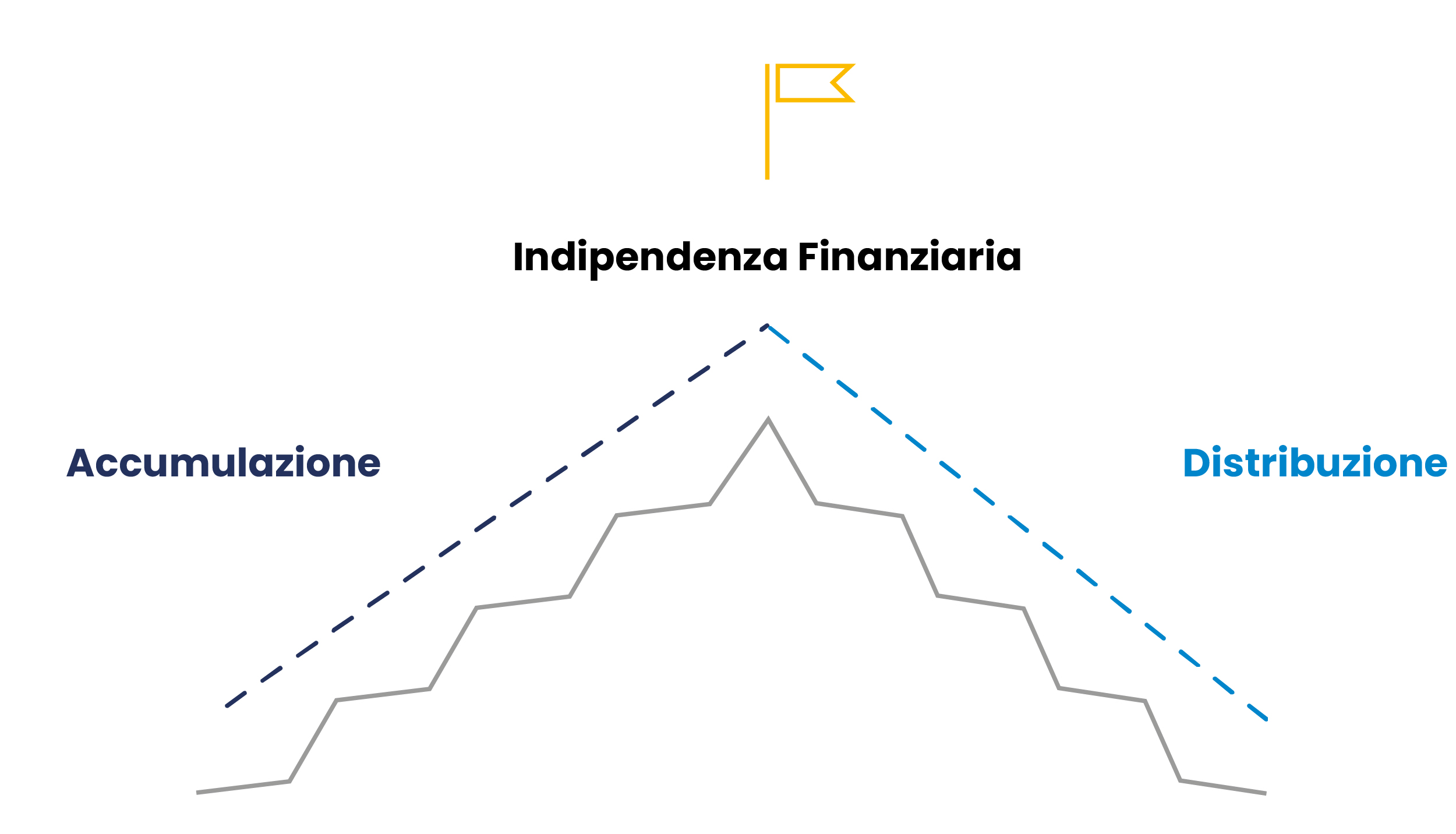

The first thing you need to consider is the stage you’re in on your journey toward financial independence.

If you’re still at the beginning, continue investing in ETFs without distractions. After ten years, when you’re in the middle phase or approaching the distribution phase with “determination,” you might consider this type of investment.

When should you buy a luxury watch? If a year has been particularly prosperous for financial markets and you use the Value Averaging method for your purchases, there will be several quarters when you won’t need to buy more stocks. This can be a good signal to consider purchasing a luxury watch.

The value of the purchase should be calculated as a percentage of your financial assets and should not exceed 5%.

The Luxury Watch I Chose

After analyzing the market from the perspective of a potential financial investor rather than a watch enthusiast, and using the usual “buy & hold” strategy, I came to the conclusion that Patek Philippe is the best choice. Here are the two main reasons I found:

- Principle of supply and demand: Patek produces only 50,000 pieces annually, far fewer than the million pieces produced by Rolex. The demand is much higher than the supply by several orders of magnitude. This factor allows Patek to maintain a high market price. If needed, you can easily resell the watch at a higher price than the purchase price. Many people, especially the wealthy, don’t have the patience to wait for long delivery times.

- Long-term vision: Patek is one of the last family-owned companies not listed on the stock exchange, which truly maintains a long-term vision. Since the company is under less short-term pressure from shareholders regarding quarterly earnings and stock performance, it can better protect the interests of its customers. Over time, Patek’s iconic advertising campaign, launched 25 years ago, has become legendary: “You never actually own a Patek Philippe. You merely look after it for the next generation.”

Luxury watches should be purchased new, exclusively from an authorized dealer, avoiding resellers and not searching for bargains on the second-hand market. Additionally, find a way to do Global Blue Tax Free. If you can’t, plan a vacation to Hong Kong, where there is no VAT on these luxury products.

To Wear or to Store the Watch?

The big dilemma is: wear it or store it? From my point of view, this investment only makes sense if you intend to wear the watch. If you plan to leave it in a safety deposit box, continue investing in financial markets with ETFs.

Beyond the numbers, a luxury watch can celebrate an important personal achievement. I bought my first (and possibly last) Patek Calatrava to celebrate my MBA, using the framework I just described to you.

It may seem strange, but I graduated in November 2019 and was able to get the watch in December 2021—it took me about two years to purchase it the right way. Patience is a virtue in both the investment world and the watch world.

In Summary

Buying a luxury watch can be an interesting alternative investment, as long as you have a clear and long-term vision. It’s not a choice for everyone, and it requires a certain level of financial maturity and patience.

Luxury watches can diversify your portfolio and offer protection against inflation, but don’t expect returns as high as those from the stock market.

If you’re ready to wear it and appreciate its value, the history of the brand, and more than just the financial aspect, it could be a rewarding investment both emotionally and economically.

In future articles, we will compare the performance of iconic models such as the Patek Nautilus or the Rolex Daytona with that of the S&P 500. Will there be any surprises?

On avance!