Increasing income is one of the steps you can take to achieve financial independence. If the idea of emigrating doesn’t excite you or isn’t feasible, there are other paths to explore, although they will require a greater time commitment.

I shared my experience on maximizing work income, focusing primarily on emigration as one of the most effective solutions.

Emigration is definitely one of the best ways to increase the likelihood of earning above-average income. Of course, this is not enough and it may not be possible for everyone.

Always Strive for Excellence

In my view, no one pays well for mediocrity. Therefore, if you are passionate about literature or philosophy, aim for excellence in that field and try to find ways and paths that can lead to profitable outcomes. A determined philosopher who studies hard may face difficulties at the beginning.

However, over time, thanks to the job opportunities offered by the digital age, they may achieve greater satisfaction than a mediocre engineer who might find a job immediately after graduation but, lacking passion or determination, ends up in mediocrity with no career prospects in the company. You must always have a long-term perspective.

In any case, it’s also important to consider the most lucrative professions in terms of salaries. Analyzing data from various specialized portals, except for very specific professions like notaries or pilots, the highest-paying professions fall into three main areas: Medical, Financial, and IT, with average incomes ranging from €50,000 to €70,000 per year. It is important to note that these average incomes include part-time workers. Those who are motivated and determined can easily double or triple that gross average income.

If you think Italy is an exception in this ranking of well-paid jobs, know that it is, but in the opposite way. In other words, the gaps in the above-mentioned areas are even greater elsewhere. For example, the ranking of highest-paid jobs in the USA shows a clear dominance of medical professions, followed by technical and business professions more or less equally. As always, the education you have doesn’t guarantee anything but only slightly increases the chances of success. Much more important, and I will never tire of repeating it, is to aim for excellence and not fall into mediocrity.

Increasing Income with Additional Earnings

Finally, if you already have a job you like, don’t want to emigrate, but your salary is not very high—say, you are a school teacher or work in the public sector—you can increase your income by starting a side activity that potentially generates a secondary income. In this case, my advice is to follow your passions and leverage your specific skills.

Here is a list of possible economic activities you could generate by utilizing your free time and skills. For now, I am not considering financial investments, which will be covered separately and in detail in future articles, as they constitute passive income by definition.

Leveraging Your Online Presence

If you have an online presence, you can earn commissions by promoting other companies’ products or services through affiliate programs.

You can offer online lessons or courses on topics you master, such as foreign languages or academic subjects, and earn through student enrollments, or sell online consulting services.

Sharing Your Knowledge

If you have a passion for writing, you can publish books on topics of interest, which is particularly advantageous if you have specialized knowledge to share with the public. Alternatively, if you have a talent for writing, you can offer ghostwriting services for businesses or individuals who need high-quality content for their website, blog, or publications.

As you can see, there are many options and large capital investments are not required; it all depends on your motivation.

Measuring Income Produced

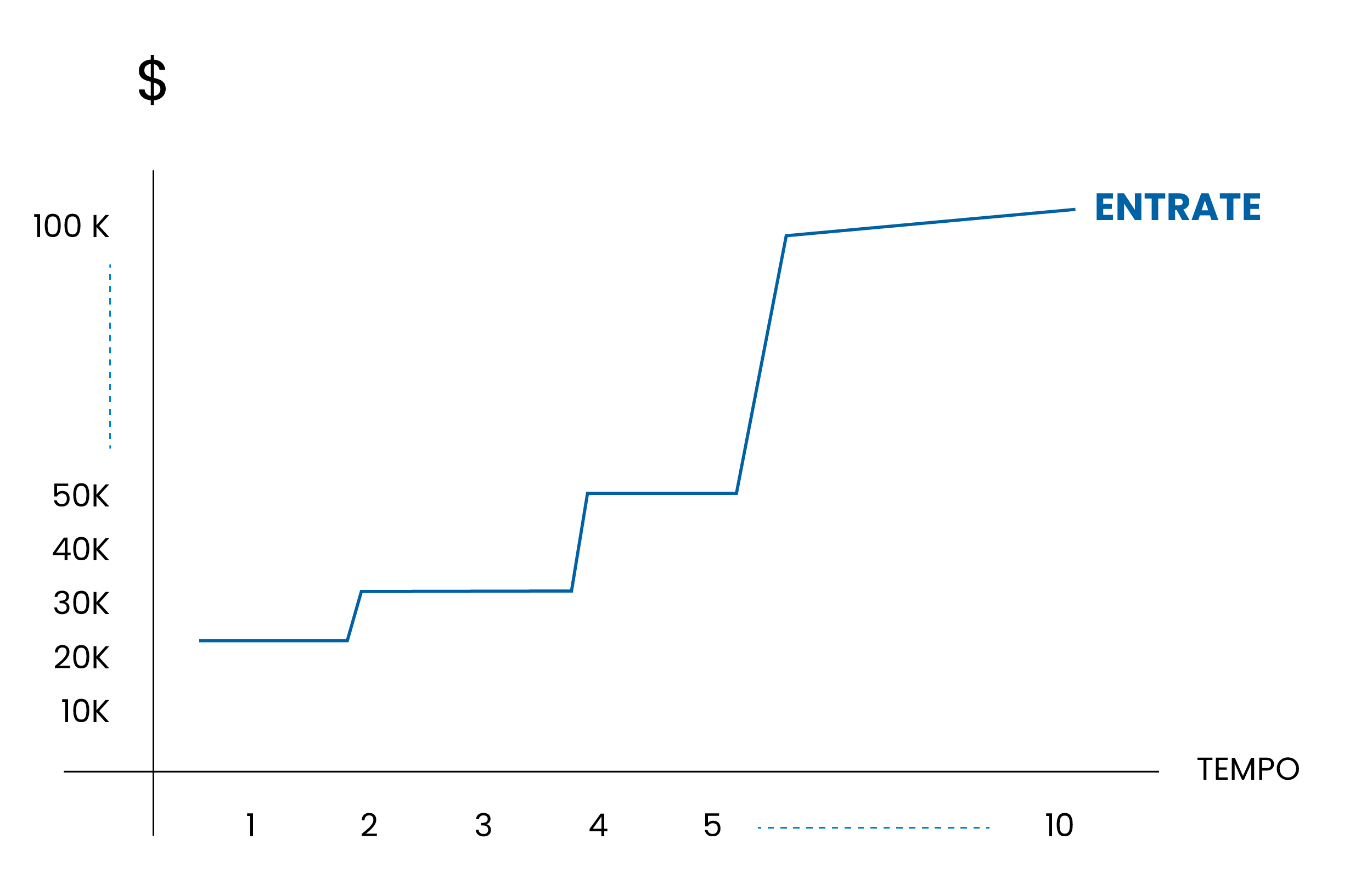

I have shared my personal experience and described different strategies for starting to increase income. I believe it’s time to present the graph that shows the trend of work income and begin analyzing it. Don’t forget that income must be constantly measured to achieve the set goals.

Work income trend over time.

Below, on the x-axis, is indicated time t, which can be a month, a quarter, or a year. In our case, it is measured in years. The choice depends on how analytical you want to be. On the y-axis, there are revenues derived from work. The histogram represents the amount of income received.

This graph will be supplemented in future articles with another line representing expenses. The difference between income and expenses highlights savings. Finally, there will be an additional integration with a third line representing investments and capital income. But for now, let’s focus on work income.

Setting Goals

I hope I have provided you with some interesting ideas to develop. You now have a complete picture of the main elements to work on to maximize your human capital and increase the income you produce.

Your income can only grow if you grow yourself

The purpose of this first step is precisely to strengthen your Human Capital (Step 1), which will in turn allow you to increase your financial income. This way, you are beginning to build the reference model, which will be integrated with Savings (Step 2) and Investments (Step 3).

The three phases to achieve financial independence.

It is very important, in order to increase the chances of success, to outline a precise path and write down your goals

I remember having a yellow post-it on my desk with the date and the figure to reach. I can say that the goal was achieved ahead of schedule. Maybe it was just luck, but setting goals certainly helps to have a clear path ahead.

I believe that mental visualization helps your brain identify the key elements of a problem. Visualizing a goal activates your mind’s predictive abilities, thereby facilitating the identification of a solution. Try to understand your strengths and weaknesses useful for increasing income. Write down the actions to be taken to strengthen your human capital and then proceed with execution.

On avance!