I have been an American Express Credit Card holder since September 2009; at the time, the stock was worth $48, and today it has surpassed $250. For almost fifteen years, American Express has accompanied me on my travels around the world without ever disappointing me. I couldn’t imagine doing without it. During this long period, I have used different versions of the card: the old Alitalia Gold, the Green one during Covid, and finally the Platinum.

However, the one that has given me the most intense emotions, and which I believe everyone should experience at least once, is the metal Platinum. I vividly remember the moment I received it, along with the “superpowers”; I still keep the original box.

In today’s society, the use of cash is unfortunately decreasing in favor of digital payments. My regret is that with cash, it is easier to keep track of and avoid impulsive spending. However, it is undeniable that electronic payments have their strengths. In Italy, the mandatory POS, along with the reduction in commissions for merchants, has accelerated the adoption of these technologies. Therefore, it is essential to understand the difference between a credit card and a debit card to make the most of their advantages

Difference between Credit Card and Debit Card

There are two main categories of payment cards: credit cards and debit cards. The most relevant difference between these two cards lies in the relationship between the holder and the financial intermediary.

Credit Card

A credit card does not require opening a bank account with the issuer (e.g., American Express), although having a bank account is still necessary. The card is issued based on a financing agreement, which sets out specific conditions such as the credit limit, interest rate, and repayment schedule. The amounts spent must be repaid periodically, usually on a monthly basis.

It is important to consider that the issuance of a credit card will be reported to credit bureaus and will affect the cardholder’s credit score.

Debit Card

Commonly known as a “bank card,” it is directly linked to a checking account and allows for transactions with immediate debit. Debit cards have spending and withdrawal limits set by the bank.

A common element for both cards is the credit limit, which refers to the amount that can be spent or withdrawn within a specific period. For credit cards, the limit is the authorized financing amount by the issuer. For debit cards, it corresponds to the spending limit imposed by the bank. Typically, the credit limit for credit cards is higher; in the case of Amex, it is variable. Among the many expenses I’ve made with my card, I remember paying for my MBA alla SDA Bocconi..

The choice between a debit card and a credit card depends on your needs, lifestyle, and career phase. Personally, I use both tools, as I consider them complementary, but I prefer the credit card. If used correctly, it can be extremely advantageous. If you want to delve deeper into the benefits, points, and how to maximize expenses, I recommend visiting The Flight Club , an excellent resource.

From Consumer to Shareholder

The American Express Platinum costs 60€ per month, totaling 720€ per year (in Italy). Wouldn’t it be wonderful to get this card for free by using dividends, transitioning from consumer to shareholder?

American Express was founded in 1850 as a value transport company. In 1882, the company launched its “payment orders,” competing with the money orders of the United States Postal Service. The first credit card was created in 1958, reaching half a million users in just three months. The first cards were cardboard and purple in color. The Gold Card was introduced in 1966, while the Platinum Card was launched in 1984, with the metal version introduced in 2017.

Today, American Express is a diversified company operating in financial services and travel, listed on the New York Stock Exchange under the ticker AXP, with a market capitalization of $178.65 billion. If you want more information about the stock’s performance or want to purchase shares, I’ve been using Interactive Brokers for years.

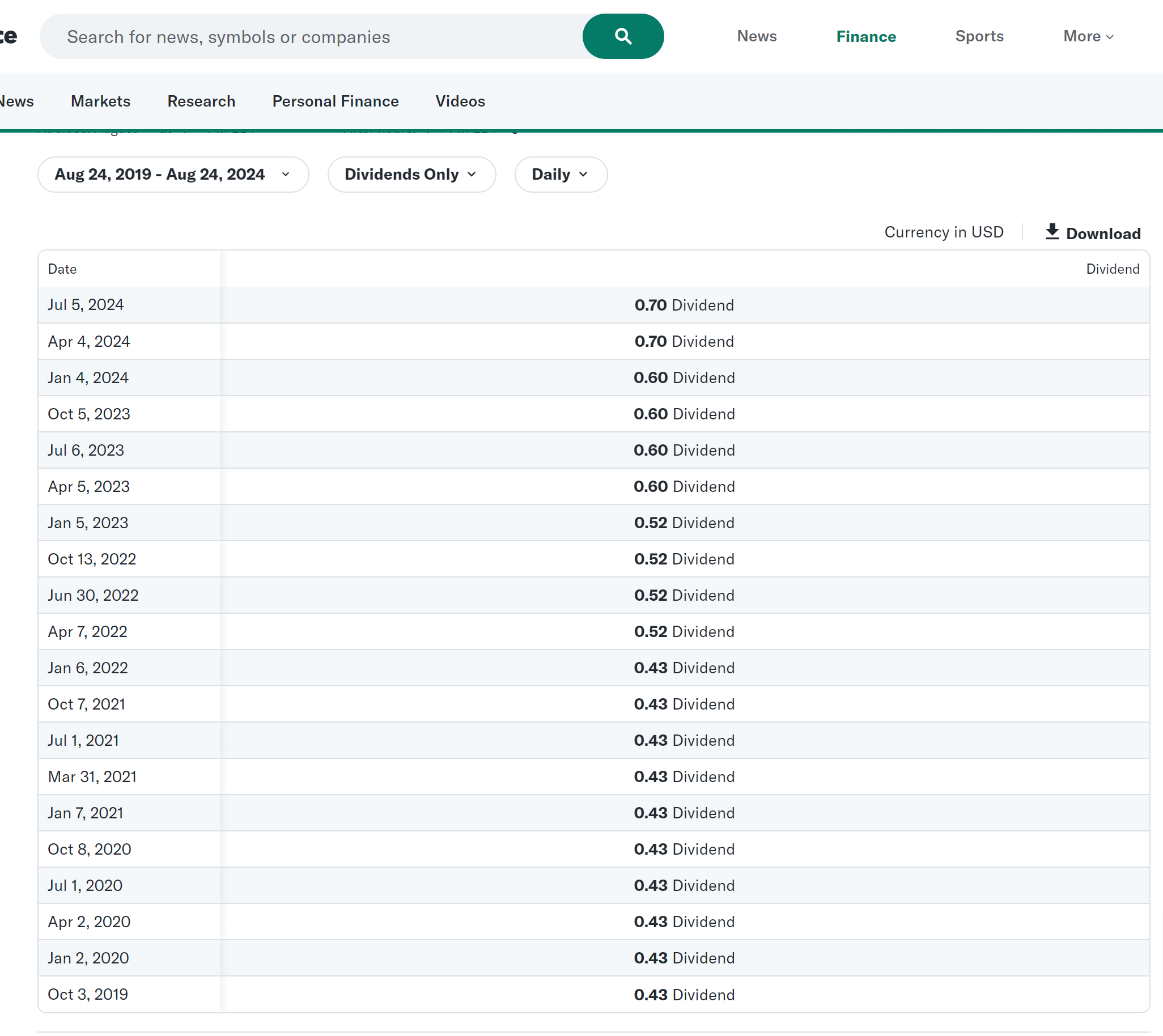

The annual dividend is $2.80 per share, with a yield of 1.11%. To cover the cost of our Platinum card with dividends, we would need to own 257 shares of the company. The company has always paid dividends on time. Here’s a table showing the dividend distribution over the past five years.

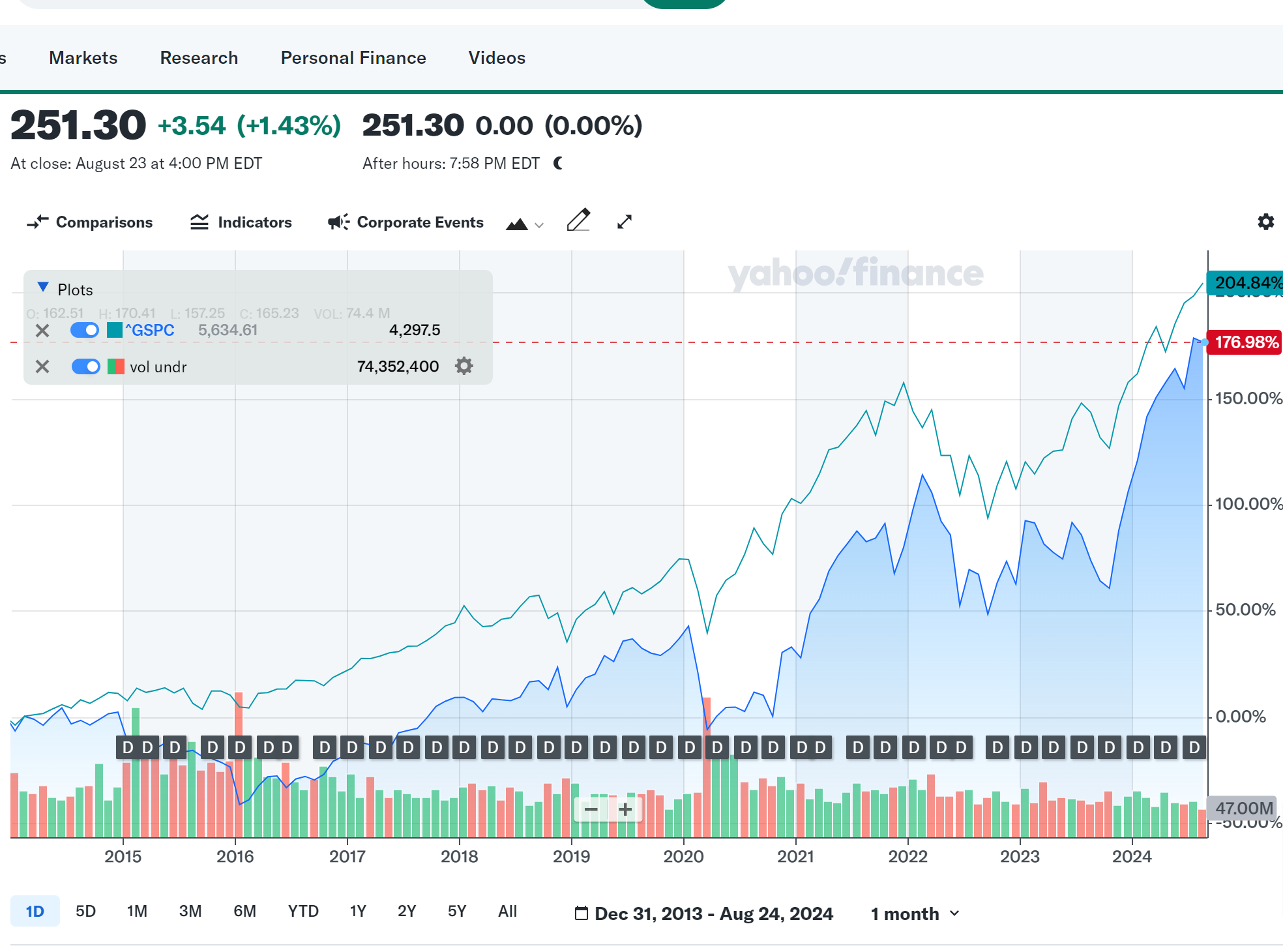

The investment required to purchase 257 shares is approximately $64,507. I wonder: could it be a good investment? To answer this question, we can consider the opportunity cost and compare the stock’s performance with our usual benchmark, the S&P 500. Of course, past performance is no guarantee of future results, but it remains an interesting indicator to consider.

AMEX Growth vs. S&P 500

The performance of the two stocks is closely correlated: over the last ten years, the S&P 500 has grown by 204%, while American Express has grown by 176%. However, investing in American Express would have provided higher dividends compared to the index, but with more volatility.

There are no free lunches on Wall Street

If we look at the possibility of obtaining the American Express Platinum card through dividends, the answer depends on what type of investor you are and your risk tolerance. On one hand, buying American Express shares to cover the annual cost of the Platinum card might seem appealing, especially considering the company’s strength and its long history of consistent dividend payouts. However, the investment required to achieve this goal is significant, with an initial outlay of over $64,000 to purchase 257 shares.

From a financial perspective, it’s crucial to always assess the opportunity cost of an investment. For example, investing the same amount in an ETF that passively tracks the S&P 500 could potentially yield higher long-term returns, even though the dividends may be lower. In this case, however, the ‘opportunity cost’ doesn’t seem particularly high and might be worth considering.

A key aspect to consider is diversification: an investment in a single stock should never exceed 5% of your overall portfolio. Never put all your eggs in one basket: this is a fundamental principle in building your investment portfolio.

On avance!

This article is for educational and informational purposes. It aims to help you make informed decisions and develop critical thinking in all areas through concrete examples. Final investment decisions remain your personal responsibility.