Is buying ETFs simple? It depends. Whether you’re a beginner or an experienced investor, here you’ll find my practical tips to make purchases simple and effective.

In previous articles, we discussed the characteristics that an ETF should have: accumulation, size, replica. Once you’ve correctly identified the financial product, you will need the ISIN code.

Now let’s move on to the steps you should follow.

Open an account with a financial intermediary

The first thing to know is that you cannot buy directly from the issuer, for example iShares by BlackRock, but you will need a financial intermediary. There are many in the Italian market; I started with Fineco Bank.

Typically, you should have a current account as a bank customer and then request to open a Securities Account. First, check that the platform allows you to purchase ETFs, as not all banks offer these products because they are not profitable (for them).

Later, as my financial education improved and my capital grew, I switched to Interactive Brokers (IB). For me, the advantage of this broker is the automatic margin account and significantly lower transaction costs compared to a traditional bank.

These are strengths not to be overlooked during the accumulation phase, which will yield benefits in the long run.

Placing the Order: Limit vs Market

If you want to buy ETFs yourself, I recommend purchasing when Wall Street is open, which means in the afternoon in Italy, and also avoid the days when the American market is closed.

To place an order, go to the order book and you will see different options, such as limit or market. In a future article, I will go into detail about these technicalities. Since I don’t do trading and buy very liquid products like the S&P500, I haven’t noticed significant differences.

For completeness; with a market order, you place an order to execute the transaction at the best available current price. There is no upper or lower limit on this price.

With a limit order, you set a maximum price at which you want to execute your order. Your order will never be executed at a price higher than your limit price.

Usually, after checking the order book, I place limit orders with a few cents of margin. Small habits.

Buying Strategies: DCA vs VA

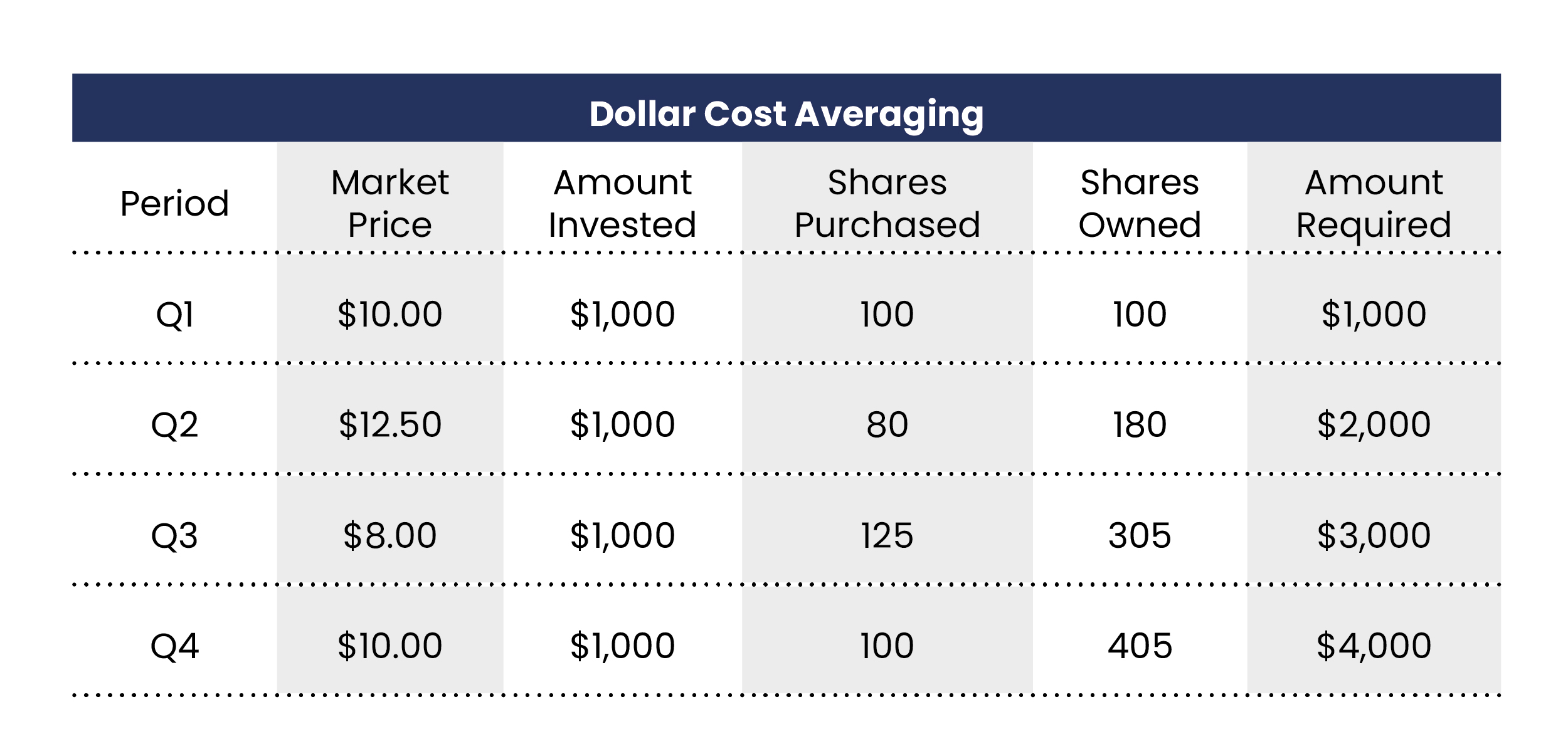

Aside from the more technical aspects, there are two main strategies for making purchases: Dollar Cost Averaging (DCA) and Value Averaging (VA). Both choices are valid and the decision is personal.

Dollar Cost Averaging (DCA), known in Italian as Accumulation Plan (PAC), is the easiest to implement. You will set a fixed amount regardless of market trends, avoiding market timing. The amount has already been set in the budgeting phase and the process automated.

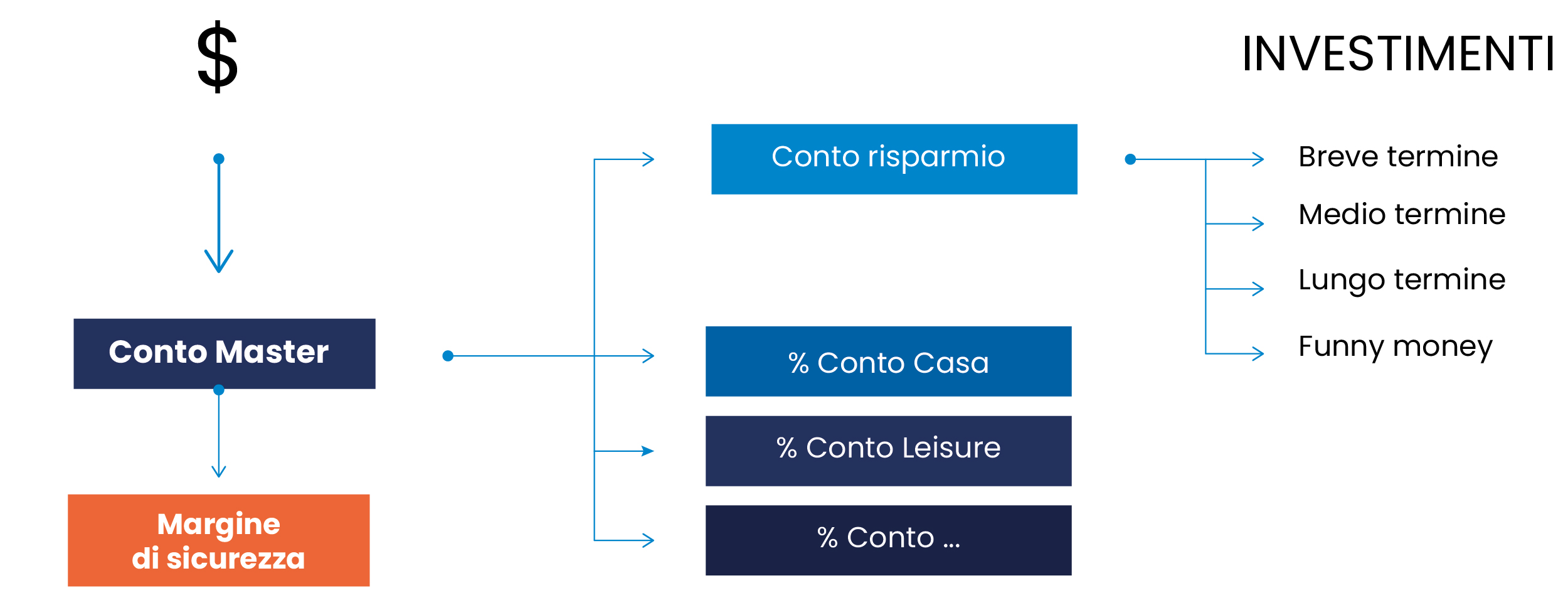

The financial map for money management.

This technique is also recommended if you receive a large sum of money (Lump sum). For example, if you sell a property, receive an inheritance, etc. Divide the amount by 10, set a purchase date, and put it on autopilot.

Here’s a numerical example of the DCA strategy, investing €1,000 every quarter:

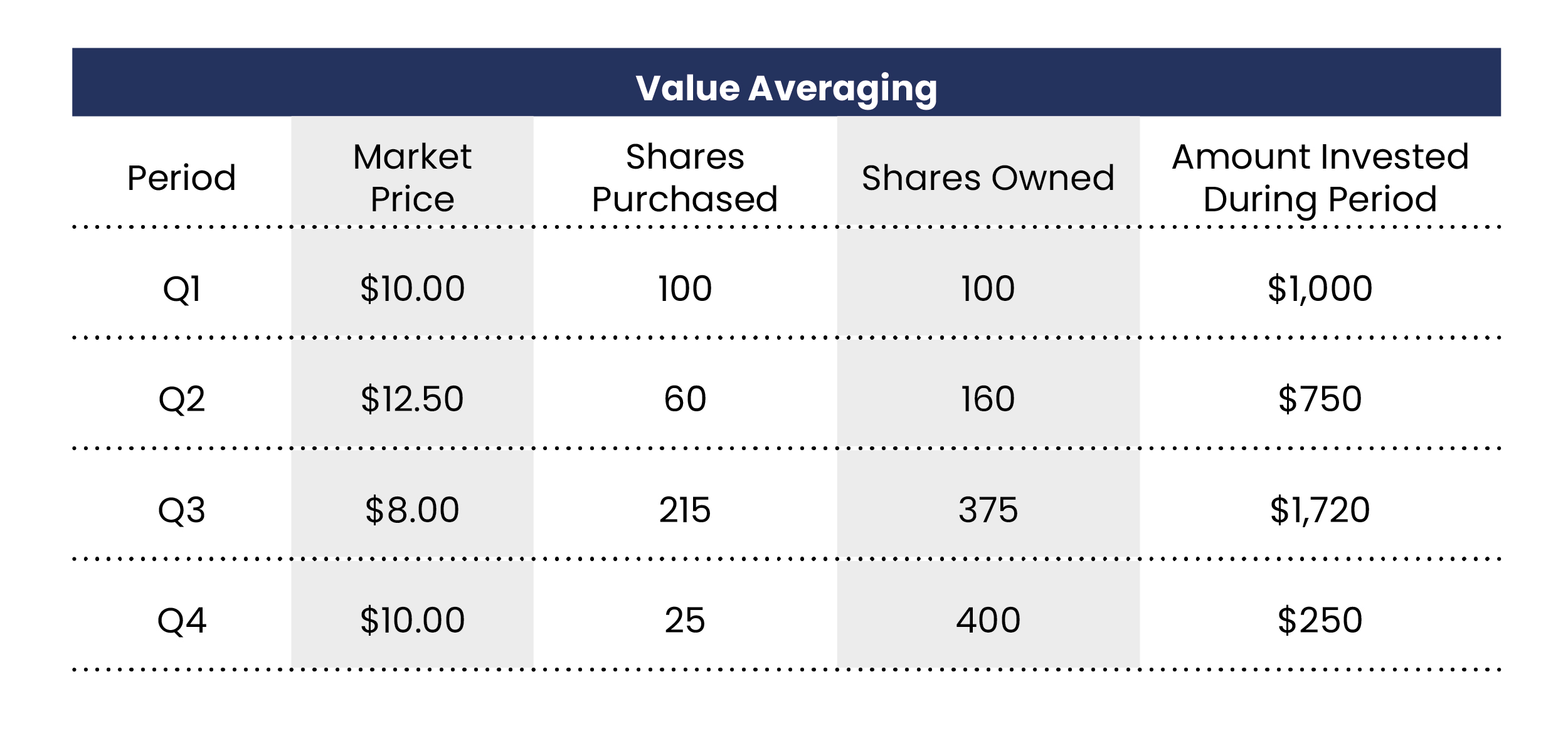

Value Averaging (VA) was introduced by Michael Edelson and requires more effort but also provides greater rewards in terms of returns. I recommend reading his book Value Averaging: The Safe and Easy Strategy for Higher Investment Returns which is rich in tables and data on the subject.

You will need to invest to maintain the value of your investment, making it extremely flexible and pushing you to buy more shares when markets are down and none when markets are up, to maintain the value of your assets.

For simplicity.

Similarly, if our portfolio’s value needs to be €1,000 every quarter, let’s see what happens based on market trends.

Comparing the two strategies shows a slight better result for VA.

Personally, I prefer to accumulate on a quarterly basis, following the Value Averaging technique, and occasionally use the broker’s leverage to maintain the value of my portfolio according to my investment plan.

Using VA, you won’t get rich quickly, but you can add a few percentage points of return which, combined with the use of low-cost tools and efficient brokers, will provide a boost to reach financial independence more quickly.

Moving Average

One final tool that can provide useful information during the purchase process is the moving average. The most common ones are the 65-day and 200-day moving averages.

In finance, everything that goes up eventually comes down

This phenomenon is called mean reversion.

This information may allow you to increase ETF purchases under certain circumstances and push the accelerator more. If on the planned date, the ETF is below the 200-day moving average, try to buy more shares in addition to those already planned in your accumulation plan.

Using VA and the moving average, you probably won’t get rich quickly, but you can add a few percentage points of return which, combined with low-cost tools and an efficient broker, will give a boost to reach financial independence a few years ahead of schedule.

Key Points to Remember When Buying ETFs

In conclusion, buying ETFs may seem complex at first, but by following the right steps, you can optimize your investments and achieve your financial goals. Here are some key points to remember:

Choose the right financial intermediary. Not all brokers offer the same advantages. Carefully evaluate the available options and choose the one that best fits your needs and financial skills.

Adopt a consistent investment strategy. Whether you choose Dollar Cost Averaging (DCA) or Value Averaging (VA), the important thing is to be consistent and disciplined in your investments.

Monitor costs. Management fees (TER) and commissions can erode your returns over the long term.

On avance!