In the opening article of The Finance Club project “Is a Personal Finance Blog Useful in 2024?”, I questioned whether it still makes sense to write a blog about personal finance in 2024. After much reflection, I concluded that despite everything, it could still be an interesting project because it is always a good time to share knowledge on financial education, savings, and investments.

Today, I am bringing you the testimony of Giovanni Come, author of one of the most authoritative and longstanding personal finance blogs in Italy: ComeDiventareRicco.com

TFC: Dear Giovanni, first of all, congratulations on starting your blog in 2008 and continuing to write. Why did you embark on this project? Sixteen years have passed, and (presumably) have you become rich?

GC: The idea for the blog originated in 2008 with a very simple concept: keeping a diary of one’s finances and engaging with others helps on the path to wealth. That’s why I’ve always reported my results with great transparency, receiving many interesting insights and exceptional stories in return, just as yours is.

Today, I consider myself affluent, leading a satisfying life, but I still see significant room for improvement. However, my concept of wealth has changed over time. I believe that financial wealth is only a part of the equation and perhaps not the most important one. I feel I’m on the right path, but I’m not there yet. I feel a bit richer every day (especially when the markets go down…), and this feeling is greatly supported by my family, loved ones, and the people I work with. Also, managing my time more attentively now gives me great satisfaction as it allows me moments for myself to accumulate experiences and learn something new.

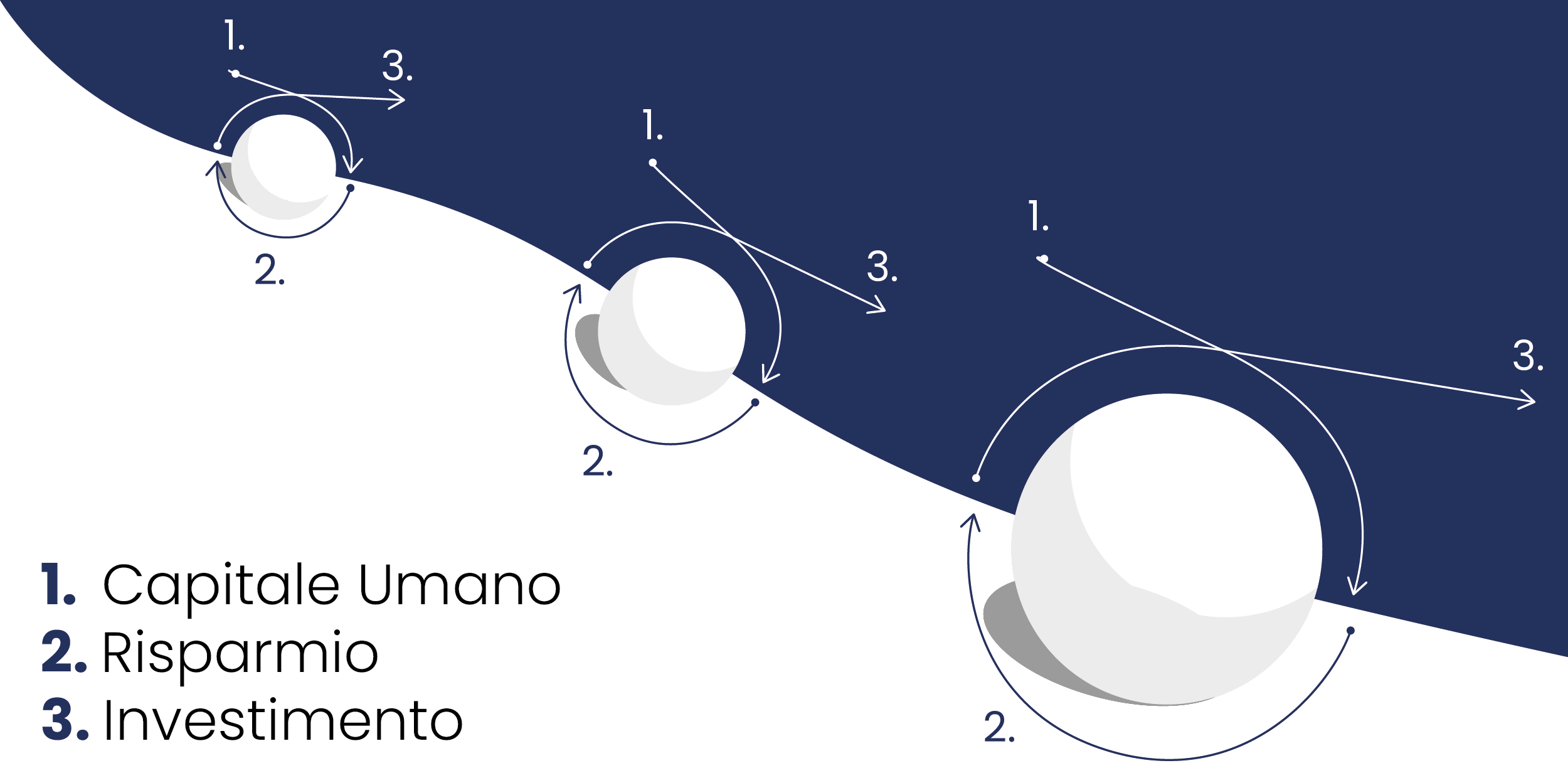

TFC: To achieve financial independence, according to my reference model, one must work on three elements: Human Capital, Savings, and Investments. In the initial phase, investing in oneself brings the most benefits, compared to financial investment. In this regard, Giovanni, tell us about your education and what you are currently involved in?

GC: I have a degree in Economics, a Master’s in Business Management, and a PhD in Economics. My education allowed me, in simple terms, to read a balance sheet and understand business dynamics, but the real experience came from the field, learning from older colleagues and international ones.

I’ve been working for 20 years in the insurance brokerage industry, managing the risks of client companies and transferring them, where possible, to the insurance market. My sector is mature, not very innovative, but in Italy, it still grows at double digits every year. This is because companies are increasingly aware of the importance of proper coverage, eliminating risks to focus on what can help them grow.

My work has allowed me over the years to achieve a good salary and, consequently, to start a savings and investment journey. Today, I have a substantial net worth, although the house I live in still represents a significant portion of it. That’s why I’m still in an accumulation phase and seek to increase my savings by boosting my income.

Given the figures involved and two school-aged children, I won’t reach financial independence soon, and perhaps never. However, I like to think that it could happen within 10 years. In recent years, I’ve made significant progress, and now my wealth grows automatically, with little effort on my part. I rely on compound interest to see exponential results.

Over the years, I’ve become a passive and lazy investor, although I don’t shy away from a few bets on individual stocks and alternative instruments. I know they’re a gamble and probably won’t make me rich, but I need them to make my journey a bit more entertaining.

TFC: The year 2008 is famous for the collapse of Lehman Brothers, an historic event. How did this event impact your project and your investments? Did you launch your project before, after the collapse, or was it a mere coincidence?

GC: The timing was a pure coincidence: I started the blog at the beginning of 2008, not anticipating that the year would be marked by the failure of such a prestigious bank. I simply wanted to become rich and share my journey from my small corner of the world.

At that time, I didn’t have significant financial resources. I had invested everything in a small house bought in 2005, and being quite young, I spent almost my entire salary on concerts, dinners, and travel. Perhaps I was lucky not to lose money, but on the other hand, I did not directly experience a market downturn that would have made me mature and change my investment approach.

The world in 2008 was completely different from today. Back then, the main investment tools were government bonds, stocks, preferably Italian, and deposit accounts. Those were the days of the famous Conto Arancio, and the privatizations were still fresh in memory.

Today, however, the world and opportunities have changed significantly. With a click, we can invest in global stocks and use instruments that replicate world indices. Italy has lost relevance, and we as investors have matured a lot.

TFC: Have your readers changed over the years, considering that people read less and the attention span is becoming increasingly shorter? Have you maintained contact with any of them since the beginning of your blog? If so, how have these contacts influenced your work and your view on personal finance?

GC: I’ve always been very reserved and, I must admit, I’ve always written without paying too much attention to readers, perhaps making a mistake. I can’t say I’ve cultivated a reader base by fostering active dialogue. Unfortunately, when you want to grow a blog, you need to pay more attention to Google than to the individual reader, at least at the beginning. Over the years, I’ve focused primarily on what interested me, delving into topics and issues useful for me, often discovered by reading forums and foreign sites. I used the blog as a method of study and learning. I often found myself writing about topics that weren’t necessarily interesting but could attract interest in terms of search keywords.

I discovered I had loyal readers especially when I became public with my YouTube channel. I was surprised to find that many creators knew my blog and considered my story a source of inspiration. Meeting some “colleagues” opened me up to really interesting stories and the discovery of tools and strategies that had a multiplying effect on my personal finance journey and beyond.

TFC: Giovanni, what advice would you give to someone, like me, who is starting a potentially anachronistic project and writing a blog in 2024?

GC: It may seem a bit counterintuitive, but I would first advise them to not limit themselves to the blog. Writing is a useful exercise and not easy. Doing it consistently is even harder. Adding to this, capturing attention and making people delve into a concept without the special effects of a video or reel is superhero-level. I would suggest exploring other avenues as well.

Today, with a blog, you can reach a part of our generation, but it’s not enough. If you really want to make an impact, you should try to use more than one communication medium. Alongside the long-form blog content, add some shorter content. I don’t like social media, but a daily thought, an image, and sharing value always pay off.

Secondly, I would advise cultivating authenticity and uniqueness. Today, it’s easier than ever to come across duplicate content, written by some form of artificial intelligence. Thus, valuable, original content that can evoke emotions, help, and change people’s lives will win out.

TFC: Besides the blog, you have a fantastic YouTube channel full of content, which I think is underrated, but that’s another story. What do you see as the main differences between bloggers and YouTubers? Which of your activities do you prefer and why?

GC: YouTube is very different from a blog. To make a video, you generally need more time and different skills. You need to be able to write, tell stories, shoot, and edit. You also need to entertain and, at times, amuse. Writing a blog article, on the other hand, is faster, but, in my opinion, requires a greater level of care and depth. The writing needs to be more polished, and the content needs to be necessarily more in-depth.

Creating videos has another aspect that can often be disarming, especially at first. On YouTube, you see the results or failure of your video immediately. If no one watches it and likes are lacking, it’s easy to feel ignored or unappreciated. On a blog, results are seen over a longer time frame, which helps you not feel pressured.

Between the two activities, I much prefer writing because it comes more naturally and immediately to me. It also allows me to reflect more, so that sometimes, when I finish an article, I find myself with new ideas and conclusions different from the starting ones. This happens less frequently when creating a video. I view video creation as a more focused activity, where I know right from the start what I want to convey. Many recommend starting with the title and cover in video creation. I see the blog as a more free and creative activity.

Both are stimulating, and I’m not sure which one I will continue with in the future. Currently, in fact, I have suspended both to dedicate myself to writing a book. I want to tell my story in detail and set definitive points in my financial journey. I like the idea of passing something on to new generations, and I needed a blank page to fill with memories, mistakes, and teachings. I will certainly ask you for advice because I consider your book one of the most immediate, easy, rich, and useful reads of recent years.

TFC: Thank you, Giovanni, you are very kind. But are you really sure you want to write a book? Because books are no longer read even if given away. Anyway, it was a real pleasure to interview you, and I wish you the best of luck with this new project.

Thank you for this brief interview and for the time you dedicated to us. It was really interesting to discuss with you. We invite our readers to follow the ComeDiventareRicco.com blog and the YouTube channel for more advice and inspiration.

On avance!