Another Personal Finance Blog: Is There Really a Need for It Today?

This is the question I asked myself before starting this new project, The Finance Club (TFC), and after publishing my first book titled: “Ho trovato l’America: I Tre passi che mi hanno condotto all’indipendenza finanziaria. At the moment availaible onlly in italian version ( I’m sorry)

Today, more and more people are seeking economic independence through investment, savings, or better money management. A personal finance blog can be a valuable resource for those aiming to achieve this goal.

If you are motivated to improve, possess patience and discipline, I believe that by sharing my personal experience, I could guide you on this journey. On the other hand, if you are looking for shortcuts to get rich quickly, then this blog is not for you.

My Model for Financial Independence

Over the past decade, I have developed a model that I will detail in upcoming articles. To achieve financial freedom, it is essential to follow three phases, each corresponding to a section of this website.

I will guide you through the use of all the tools I use daily, show you the broker I use for my investments, and the process of selecting and purchasing an ETF. I will recommend the books that have been important to me and that a good investor should read at least once in a lifetime. All of this through regular publication of articles and content.

The world of finance is constantly evolving, with new products and services influencing our decisions. Recently, new Bitcoin ETFs have been launched. This personal finance blog will help you keep up with such changes and approach them with the right mindset.

Easy to Understand but Hard to Execute

In today’s society, many people find it useful to read about others’ experiences. This project allows me to share my experiences, successes, and failures, inspiring and helping others on their financial journey.

Let Me Introduce Myself

At this point, I think it’s time to introduce myself. My name is Andrea Brandimarte. In December 2021, after a long journey, I achieved my goal: financial independence at just 46 years old, the same age at which Peter Lynch, manager of the Fidelity Magellan Fund, retired.

Technically, I am part of the FIRE (Financial Independence, Retire Early) movement, whose main ideas are outlined in Vicki Robin’s book “Your Money Your Life.” In summary, FIRE is a lifestyle model aimed at achieving financial independence and early retirement, allowing freedom to engage in beloved projects without being constrained by economic factors.

But now that I am financially free, I wonder what the future holds. Will the 4% rule really work? Perhaps financial independence is just a utopia? The feelings are different, and the questions swirling in my mind are many. In upcoming articles, I will try to provide answers, even though it won’t be easy because often “it depends,” but depends on what? This is what we will discover together on this journey.

As I write these words, I look at the calendar gifted by the bank; it’s April 2024. This means that nearly three years have passed since I entered FIRE. I have decided that others should also have the opportunity I had. For this reason, I want to share my knowledge and promote financial education topics.

Financial Education in Italy

In Italy, we are certainly fortunate in terms of welfare, but I believe there is a problem with financial education. Many concepts, even basic but crucial ones, such as the power of compound interest, are not adequately addressed in schools or are not covered at all. Furthermore, most financial literature is in English, and many fundamental texts have never been translated into Italian or have been translated with significant delays from their original publication dates. For example, Benjamin Graham’s “The Intelligent Investor,” written in 1950, was published in Italian only in 2020.

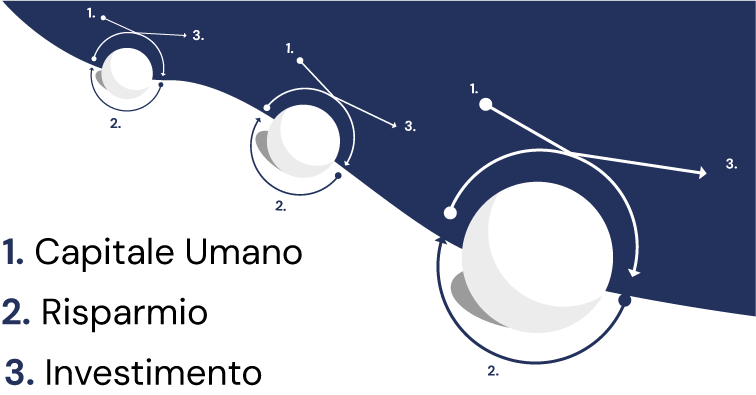

The path to financial independence is long, challenging, boring, and requires a lot of discipline. Based on my experience, I have identified three fundamental steps, which should be followed sequentially and are represented by: Human Capital, Saving, Investments.

The structure of “my” model is circular, with the three components feeding into and reinforcing each other over time through diligent and continuous work, leading you towards a natural evolution.

The Three Phases to Achieve Financial Independence

Keep in mind that as you advance towards your goal, you will encounter more obstacles and make more mistakes. I have made many mistakes in all three phases, and it’s normal; it’s part of life. I have fallen many times, but I have always had the strength to get back up and emerged stronger. The secret is to understand the cause of the fall, work to solve the problem, and turn it into an opportunity. You may wonder how this is possible; we will discover it together. Often, the answer will surprise you.

One of my favorite Japanese proverbs says: Nana Korobi Ya Oki. This principle of resilience will always guide us on our journey.

Fall Down Seven Times, Get Up Eight

The Personal Finance Blog TFC

The TFC project aims to provide solutions based on what I have experienced firsthand. It goes without saying that what has worked for me may not work for everyone. The world is very complex, and every individual is different. However, I can assure you that some principles can be considered universal.

One lesson I have learned is that it is very important to have both a predetermined plan, Plan A, and also a Plan B. Even if it’s not perfect, it’s crucial to have it because, in the event of an unforeseen occurrence, it is always better to react using the analytical part of our brain, represented by the controlled operations of “System 2,” rather than acting based on emotions with the instinctive operations of “System 1.” If you want to delve into this concept, I recommend reading Daniel Kahneman’s book, “Thinking, Fast and Slow.”

In the end, the goal is to achieve financial independence, a concept that can philosophically be represented by the parable of the six blind men and the elephant.

There Were Once Six Wise Men Who Lived Together in a Small Town. The Six Wise Men Were Blind.

One day, an elephant was brought into the city. The six wise men wanted to know it, but how could they being blind? “I know,” said the first wise man, “we will touch it.” “Good idea,” said the others, “so we will find out what an elephant is like.”

The six wise men went to the elephant. The first wise man approached the animal and touched its large, flat ear. He felt it moving slowly back and forth, producing a nice, cool breeze and said: “The elephant is like a big fan.”

The second wise man touched the leg: “You are wrong. The elephant is like a tree,” he said. “You are both mistaken,” said the third. “The elephant is like a rope,” as he touched the tail.

Then the fourth wise man touched the sharp tip of the tusk. “Believe me, the elephant is like a spear,” he exclaimed.

“No, no,” said the fifth wise man, “what nonsense! The elephant is like a high wall,” while touching the elephant’s tall side.

The sixth, meanwhile, had grasped the trunk. “You are all wrong,” he said, “the elephant is like a snake!” “No, like a rope.” “No, like a fan.” “Like a snake!” “Wall!” “You are wrong!” “No, I am right!”

The six blind men continued to argue for an hour, each one insisting they were right, and they never discovered what an elephant was really like!

For me, personal finance is like the parable of the six blind men and the elephant. Each of us touches only a part and thinks they know everything.

What I will try to do in this project is to describe “my” elephant.

On avnance!