Risk Tolerance: A Key Factor in Financial Investments

Do you think having 100% exposure to the stock market is risky? Things aren’t always as they seem.

Risk tolerance is an extremely complex topic. You might be surprised, but this has been my asset allocation for almost ten years. To be precise, as I write this article, it’s at 96% because I have 4% in cash in my Interactive Brokers account.

Actins to Grow Your Capital

During the accumulation phase, stock investment is what every investor should consider to grow their capital. I believe that stocks always win in the long run. Growing capital over the long term means:

Doubling Your Capital Every 7 Years

How is that possible? Assuming an annual return rate of 10%, which is the historical return of the S&P 500, and using the rule of 72 (72/10=7.2), your capital would double approximately every 7 years.

Can Risk Really Be Measured?

Throughout your journey toward financial independence—often referred to as the mountain to climb—your risk tolerance will be constantly tested

I believe risk is very difficult to measure in advance using traditional tools like theMIFID (Markets In Financial Instruments Directive), questionnaires, as it’s a qualitative and highly personal factor. On the other hand, I fear there is no alternative tool to measure it in advance. The only way to truly understand your risk tolerance is to test it empirically, through your own experiences:

Skin in the game

As we’ve seen with the Value Averaging strategy, it is more prudent to enter the market gradually. One of the many advantages of this strategy is that it helps you reflect on what your risk tolerance might be.

During the accumulation phase, encountering bear markets will be inevitable.

Your capital, your savings ability, and your time horizon are the three levers to consider

I’ve encountered several bear markets, including the one caused by the pandemic. At that time, my portfolio lost over 40% in an extremely short period—just a couple of months between February and March 2020. None of us had a “crystal ball” to know whether the recovery would be U-shaped, V-shaped, or L-shaped.

Risk Tolerance and Invested Capital

Financial markets are not a zero-sum game. If one party buys at a certain price, there will be another party willing to sell. Most importantly, it’s essential to remember that markets are unpredictable in the short term.

The amount of capital invested can be a decisive factor.

If your capital during the event had been $10,000, during that period you would have virtually lost 40%, or $4,000. It’s certainly a loss, but one that can be easily recovered with a few extra months of savings.

It’s a different story if you had $ 500,000. In that case, the loss—though virtual—would represent years of savings and potentially ruined plans.

The question I invite you to reflect on is: what would you do if your financial wealth were suddenly cut in half by the biggest market crash in history?

If your answer is: “I would try to buy more shares, even with leverage; I would continue to follow the financial plan diligently and never sell, because the losses would then become real,” then you’re on the right track, you’ve achieved the right mindset, and your portfolio suits you because you clearly understand your risk tolerance.

On the other hand, if you can’t sleep at night, start compulsively checking stock prices and news, then you may have some biases to work through, and it’s very likely that you would end up selling—naturally at the worst possible moment—turning your loss into a reality.

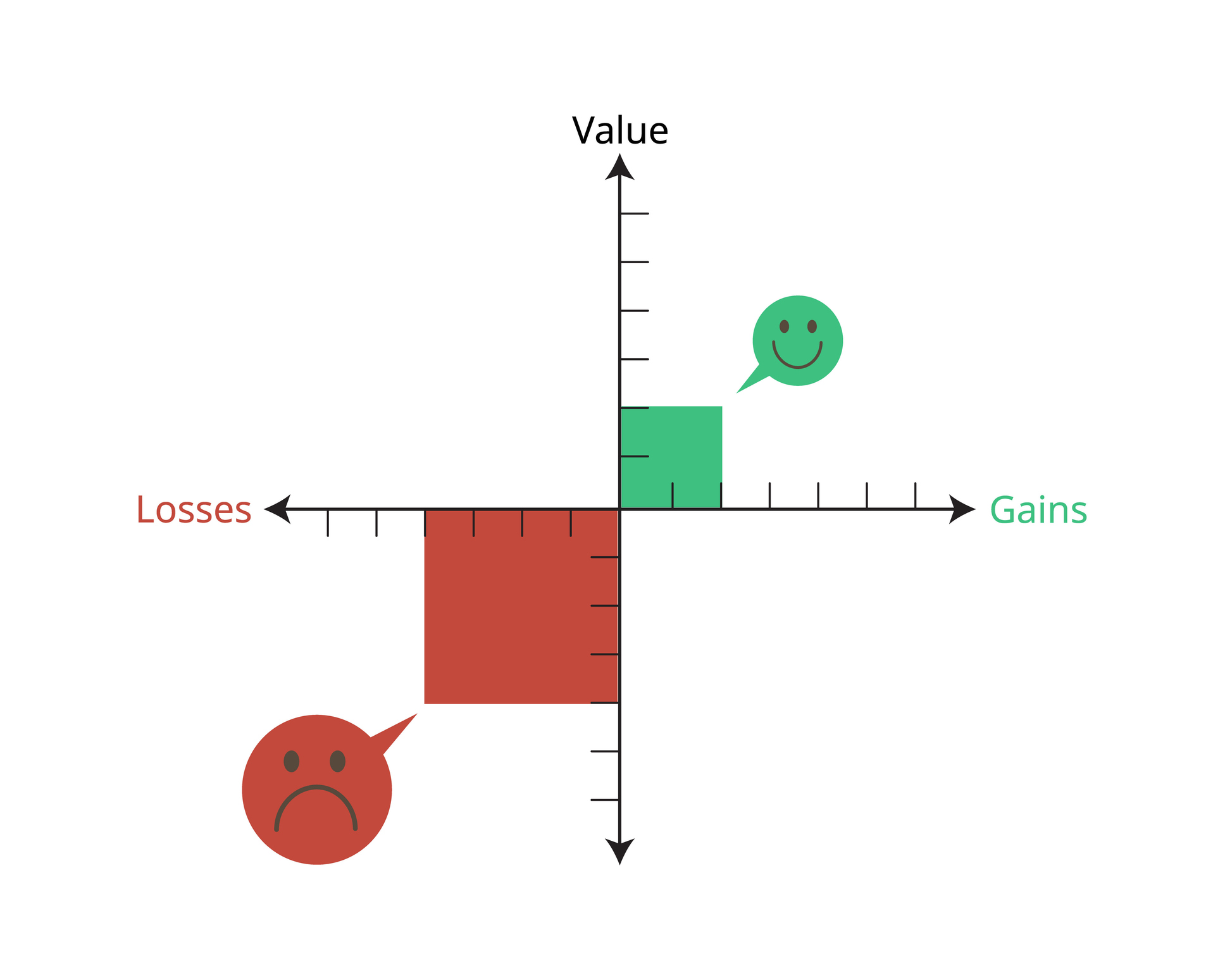

Loss Aversion

As Israeli psychologists Daniel Kahneman and Amos Tversky taught us in 1979 with , Prospect Theory our brain is averse to losses. The response to losses is stronger than the response to gains; we assign double the value to the former.

Prospect Theory, Kahneman and Tversky, 1979.

It’s very difficult to predict how you’ll react to certain events. I found strength in books; I had prepared myself, wasn’t caught off guard, and in the end, things turned out well for me. I didn’t sell, and I had the courage to buy.

My probability-based approach allowed me to keep my cool, and I came out stronger after the last crisis. Because I had time on my side, this brings into play the time horizon, which we will explore in more detail from a different perspective in the next article.

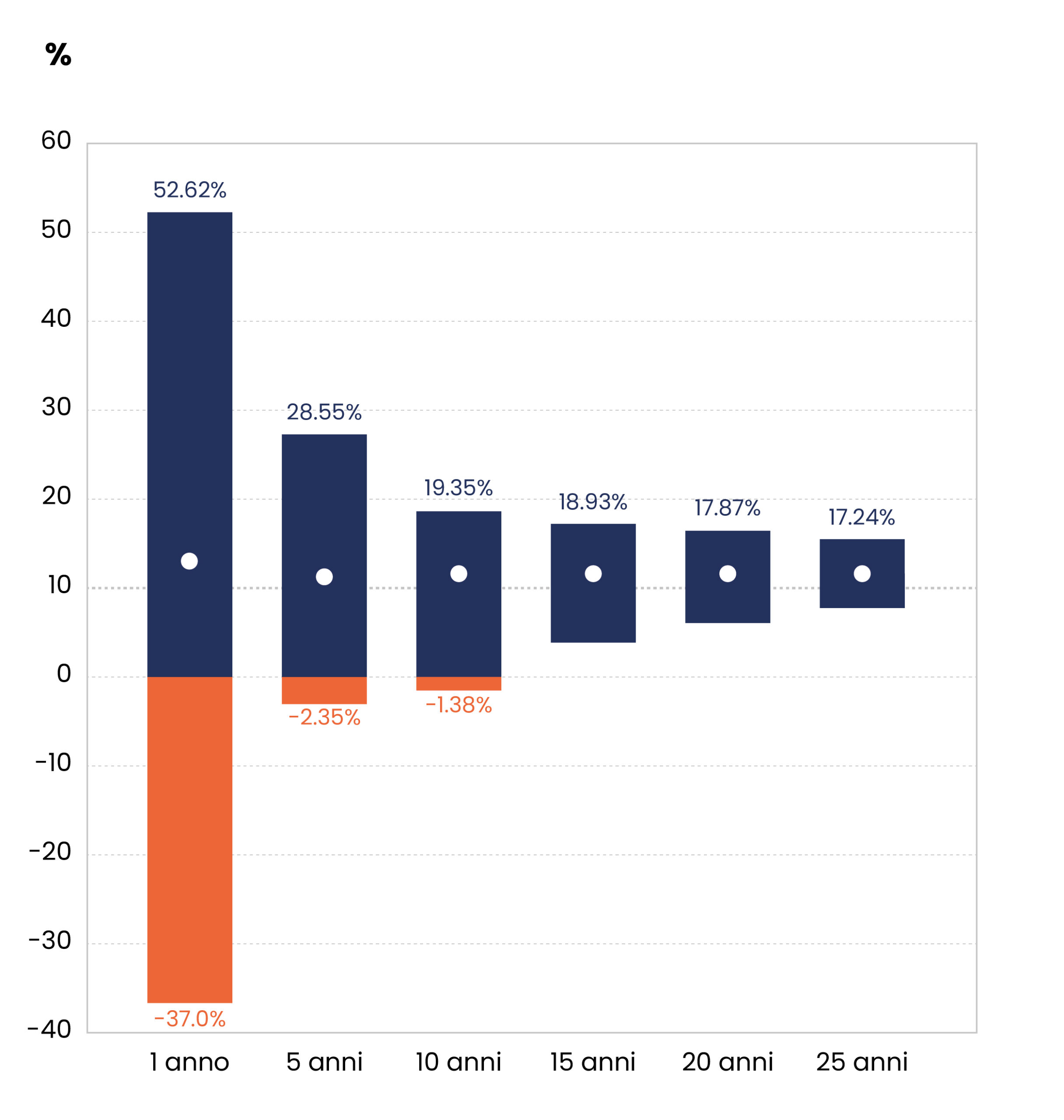

The table below shows that with a time horizon of 5-10 years, the probability of losing money is extremely low.

Necessary Return to Recover Losses

One saying on Wall Street is that we’re all long-term investors until a real bear market hits. At that point, many long-term convictions start to waver.

Risk Tolerance and Financial Independence

As you’ve seen, the path to financial independence is quite long and turbulent; you must be patient and disciplined. Reflect on your risk toleranc

On avance!