Accumulation represents one of the phases in your journey towards financial independence. Before you start investing in the stock market, you should ask yourself what stage you are in on your path to financial independence and whether the goals you wish to achieve are short-term, medium-term, or long-term. There is no favorable wind for the sailor who does not know where to go.

These questions may seem trivial and are occasionally overlooked, but they are not. You need to have a clear idea before embarking on the journey.

As Warren Buffett said:

The first rule: never lose money. The second rule: never forget the first

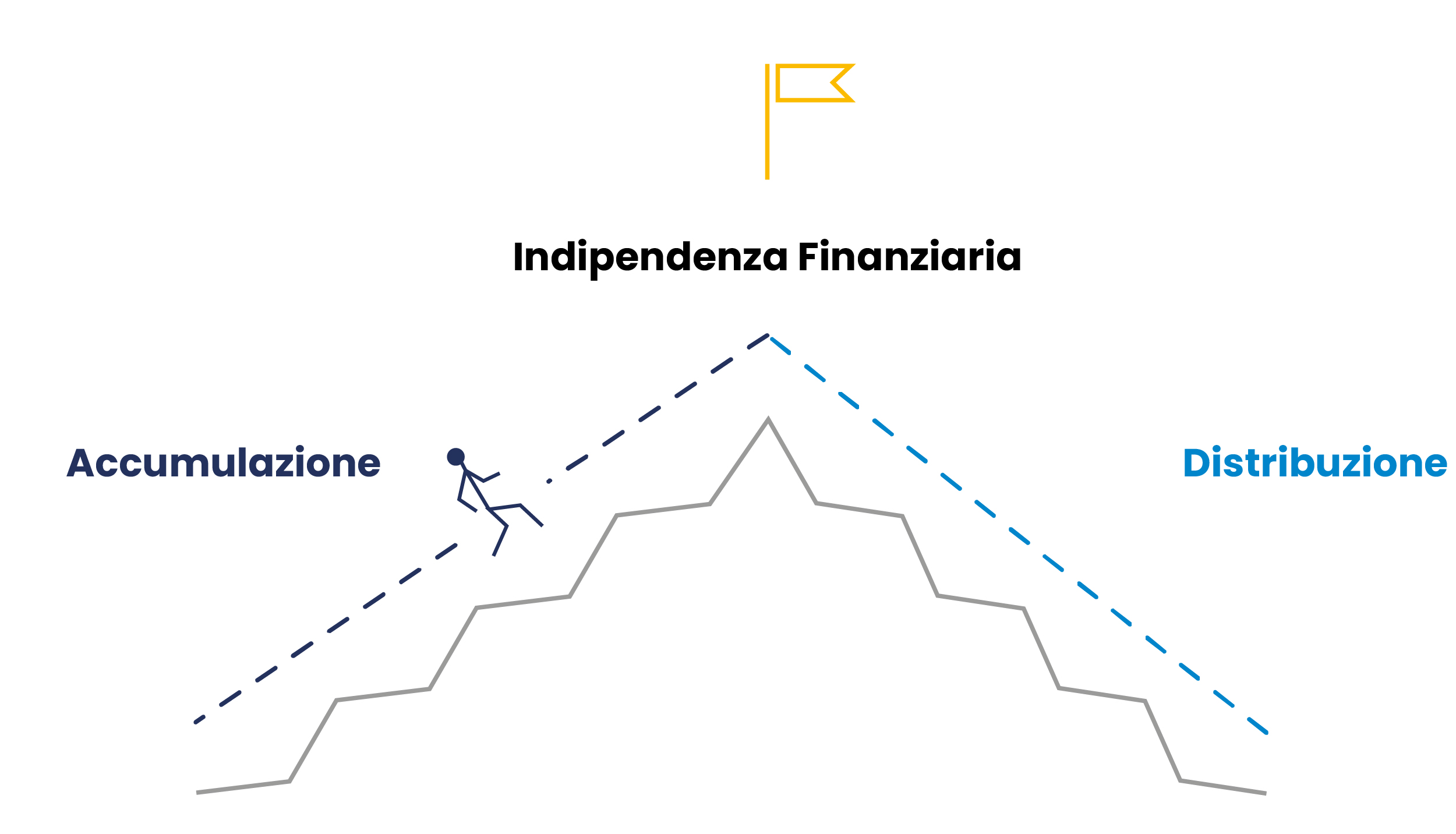

The investor’s journey has two main phases. The first is the initial phase, known as the accumulation phase, which can be metaphorically represented as climbing a mountain. In this case, we need to reach the top as quickly as possible.

Economic translation: investing by leveraging compound interest.

The second phase is distribution, which can be described as the golden goose. We should not kill or stress the goose too much because it needs to continue laying golden eggs.

Economic meaning: having withdrawal rates on the capital not exceeding 4%.

The accumulation phase.

Goals of Accumulation

In the accumulation phase, the goal is to grow the capital as quickly as possible, while in the distribution phase, it will be to protect it to continue receiving its benefits perpetually. The financial tools to use and the percentages of different asset classes will change over time. In the accumulation phase, there are rules that need to be followed and must be clear from the start in building your investment portfolio.

In the financial world, there are different investment classes. These are the main ones:

- Stocks The tool for participating in the ownership of a company. Specifically, a stock represents the minimum share into which the capital of a company is divided;

- Bonds A security that gives the investor who buys it the right to receive, at maturity, the repayment of the amount paid and a remuneration in the form of interest. The issuer, for whom the bond represents a debt, uses the received amount to finance itself;

- Gold A store of value, a means of payment;

- Commodities A particular category of goods traded on the market without qualitative differences. Specifically, these are so-called fungible goods, which can be substituted in meeting the need they are associated with, regardless of who produces them;

- Real Estate Investment Trusts (REITs) Investment funds that allow people to invest in real estate portfolios;

- Cash Cash in Euros, Dollars, or other currencies.

This is my personal classification because I consider liquidity a strategic asset class in building my portfolio.

Navigating the Available Tools

Each investment class has subcategories. For example, the equity component can be divided based on company capitalization (large, small) or other factors such as Value and Growth. Bonds, on the other hand, can be classified based on the issuer (issued by states or corporations). As you can see, there are many tools available, and it is not easy to navigate at first.

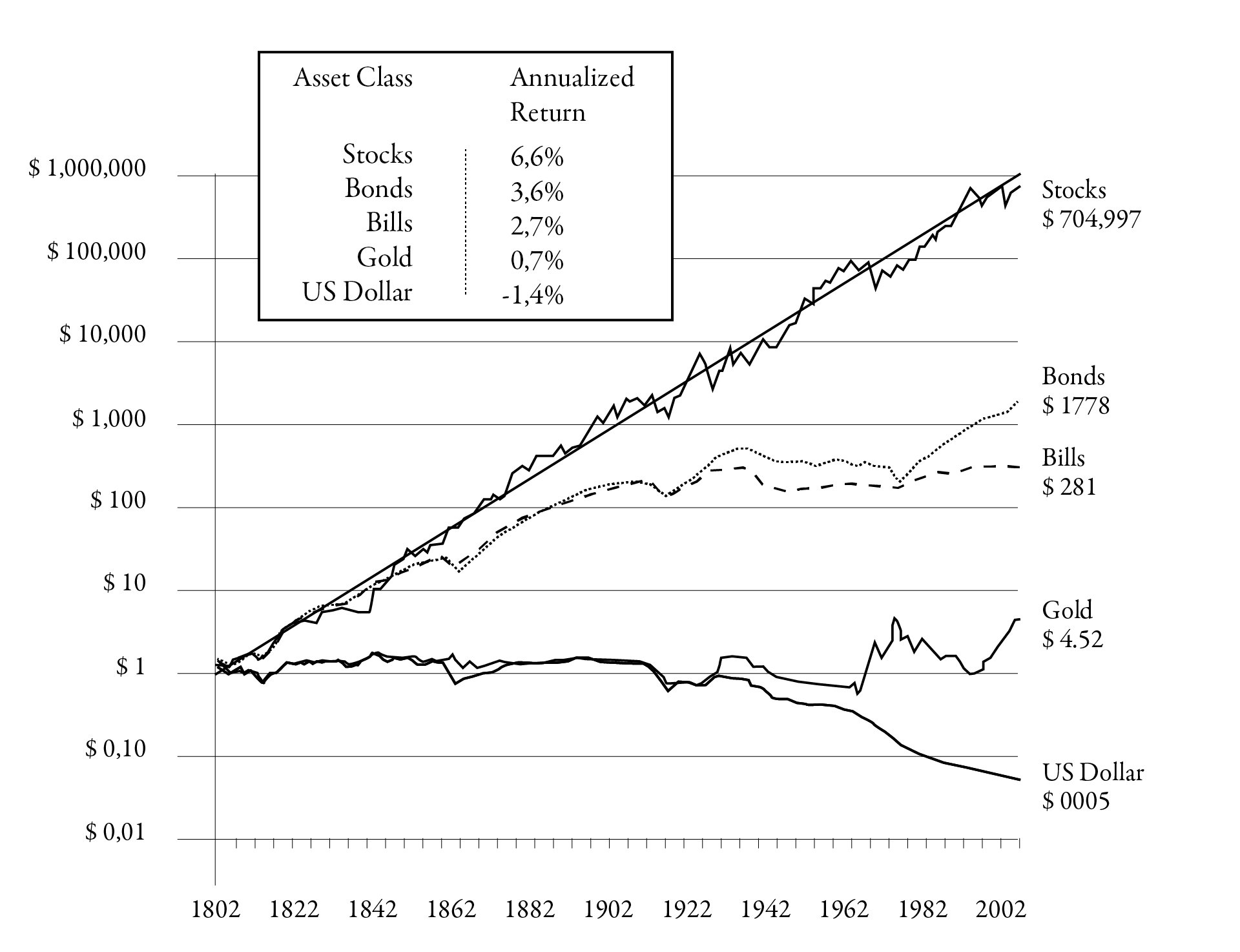

Below is a graph that is very important to me, borrowed from Professor Jeremy Siegel’s book, Stocks for the Long Run. The data shown illustrate the performance of major asset classes from 1802 to 2002, allowing us to debunk some myths.

Total Real Return on U.S. Stocks, Bonds, Gold and Dollar, 1802-2012.

Strategic vs Tactical

One last important clarification. When we define the percentage of macro variables that make up the investment portfolio, such as the allocation between stocks and bonds, this aspect is known as Strategic Asset Allocation.

On the other hand, if within the equity component, we decide on a geographical allocation or choose to focus on a specific factor, such as Value stocks, it is commonly referred to as Tactical Asset Allocation. You need to be clear that the strategic choice will make the difference in the long term, not the tactical one.

For now, we have defined where you are in your journey and the main investment classes. In the upcoming articles, we will delve deeper into the technical characteristics of the major asset classes.

On avance!