Myths about home ownership have significantly contributed to the dismal scenario of poor financial education in Italy. Have they told you that buying a house is always better than renting? Yes, they’ve taught you that and drilled it into you almost as if it were a dogma.

The real answer is different and it will surprise you.

In the section dedicated to Human Capital, we explored different scenarios and strategies to increase your income, focusing on career opportunities. Now it’s time to take a step forward.

Imagine that after a few years of hard work, you’ve secured a good job, perhaps abroad, and are earning $10k a month. Your career has taken off, but it’s important to keep your feet on the ground because you’re still at the beginning of the journey towards financial freedom. Now you need to learn how to manage the money you’ve earned through so much sacrifice.

Social Pressure

The first enemy you will have to fight is yourself and social pressure. The biggest risk is falling into a loop that generates personal inflation, nullifying your efforts and earnings. Money management, like many other topics discussed on my blog, is not taught in schools, and often families adopt incorrect approaches. It is essential to acquire proper financial education to successfully navigate this second step.

Traditionally, Italians are great savers. This is evidenced by the fact that the percentage of homeowners is 72.9%. Additionally, we used to be called “BOT people” and the current rise in interest rates has rekindled the Italian love for fixed-income securities. The recent May 2024 issuance of BTP Valore raised the significant amount of 11.3 billion euros. These figures simply confirm that historically we are inclined towards the art of saving, which is a good starting point, but predisposition alone is not enough.

If you want to achieve financial freedom, you need to take actions different from most other people

When you’ve secured your first permanent contract and finally achieved some economic stability, my advice is not to buy a house immediately. You read that right: DO NOT buy a house.

I know you think it’s a good investment, that the social pressure is strong, and probably your parents will tell you that rent money is wasted and will help you financially, and so on. These are just myths about home ownership, and the numbers prove it.

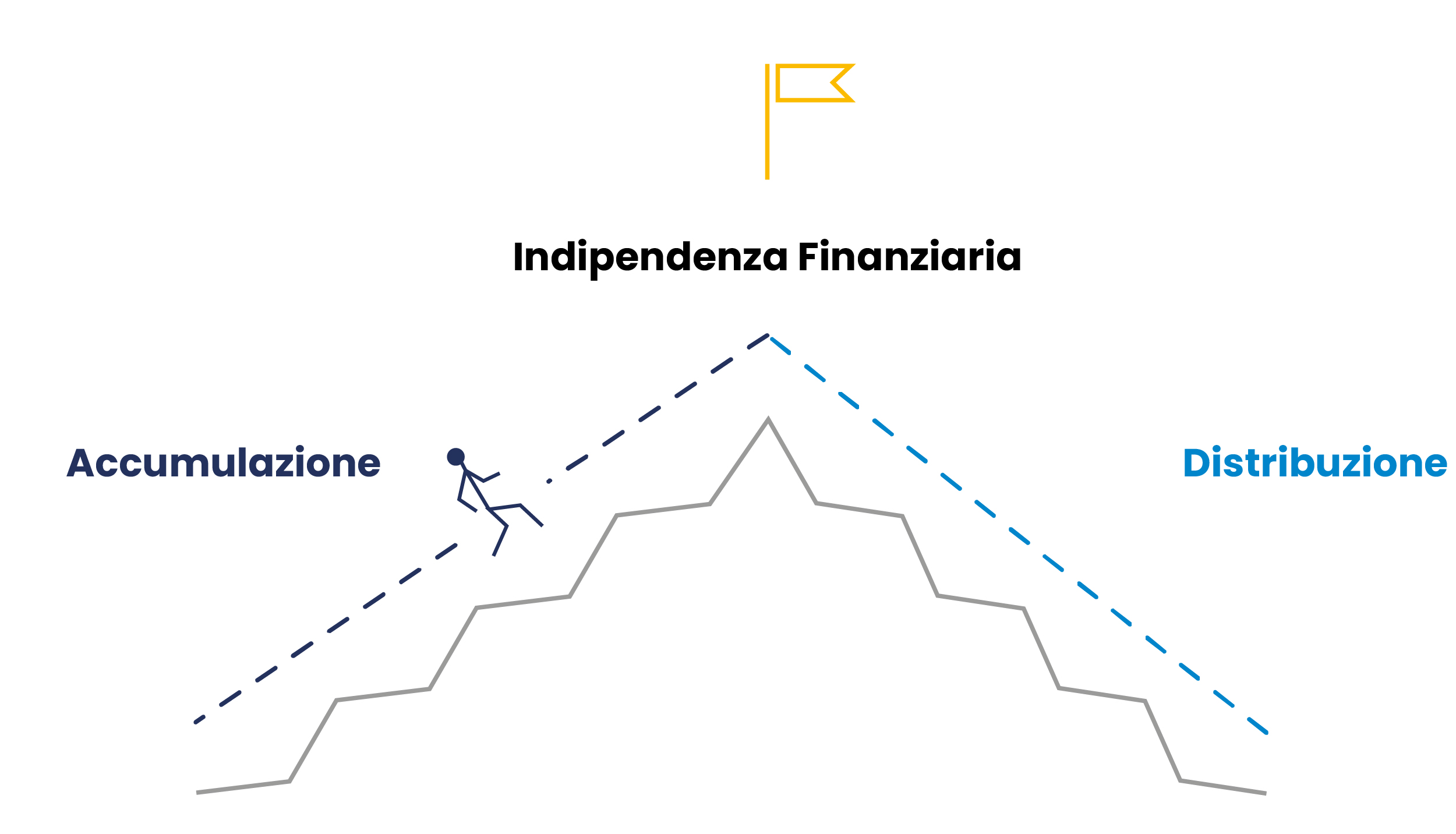

The point is you are still in the initial phase of your journey, that of accumulation, and buying a home is not yet a priority. Later, you’ll enter the distribution phase and can make different choices. The issue of home ownership is relevant to all of us.

The accumulation phase.

Renting and Financial Investments vs. Buying and Immobilization?

To make an accurate analysis methodologically and consistent with your goal of achieving economic independence, you need to correctly compare the costs of renting and buying a property. Part of these costs is present in both cases and should not be accounted for in the model that will help you understand what is more advantageous. Subsequently, it is crucial to analyze the opportunity cost of using money to buy a home.

Let’s assume, for simplicity, that part of the property value is a gift, which was the case for me. The remaining part will likely be your capital, which could potentially be used for alternative investments. The greater your financial education and familiarity with the world of investments, the less likely you are to buy a house. This is because with greater financial education, you will be able to achieve better returns on your money.

I assure you that over a 15-20 year horizon, investing at 10% annually or keeping money in a savings account makes all the difference in the world. Yes, you read that right: 10% will be your expected return in the long term. We’ll look at how to achieve this in the section dedicated to Investments. For now, just consider that in the last 10 years, the S&P 500 has had an average annual return of around 10-12%, though this calculation can vary slightly depending on the specific period considered.

Returning to the main topic, it’s clear that the choice to buy or not buy a home is influenced by this. If you want confirmation and to delve deeper into the topic, I recommend using The New York Times calculator which explains this concept with numbers in a clear and thorough manner.

Summarizing the Myths About Home Ownership

In conclusion, it’s crucial to understand the importance of opportunity cost when making financial decisions. The first step towards financial independence is learning to manage wisely the money earned through hard work, avoiding premature investments like buying a house. While purchasing a home may seem like a traditional and desirable goal, it’s important to carefully evaluate whether it’s the right choice in the early stages of your financial journey. Using your savings for alternative investments with potentially higher returns can accelerate the achievement of financial freedom.

Remember that social pressure and the desire to follow the crowd can lead you to make impulsive financial decisions. Investing time and energy in financial education will help you make informed and thoughtful decisions, maximizing your long-term returns.

The road to financial independence requires discipline, knowledge, and the ability to resist the temptation of immediate and unnecessary expenditures. With these premises, you will be able to make wise financial choices that will bring you closer to your ultimate goal.

In upcoming articles, we’ll explore common mistakes related to mental accounting biases. For example, have you ever fallen into the euphoria of receiving a bonus and bought the latest trendy smartphone?

On avance!