Sometimes I wonder: how can we simply define wealth?

Technically, wealth can be defined as the amount of economic resources accumulated by an individual at a certain point in time and is a quantity that can be easily measured. In this article, we will attempt this exercise, and you might be surprised by the result.

To proceed correctly, first, we need to perform a quantitative analysis of your current situation. Later, based on the data obtained, we will outline three different forms of wealth.

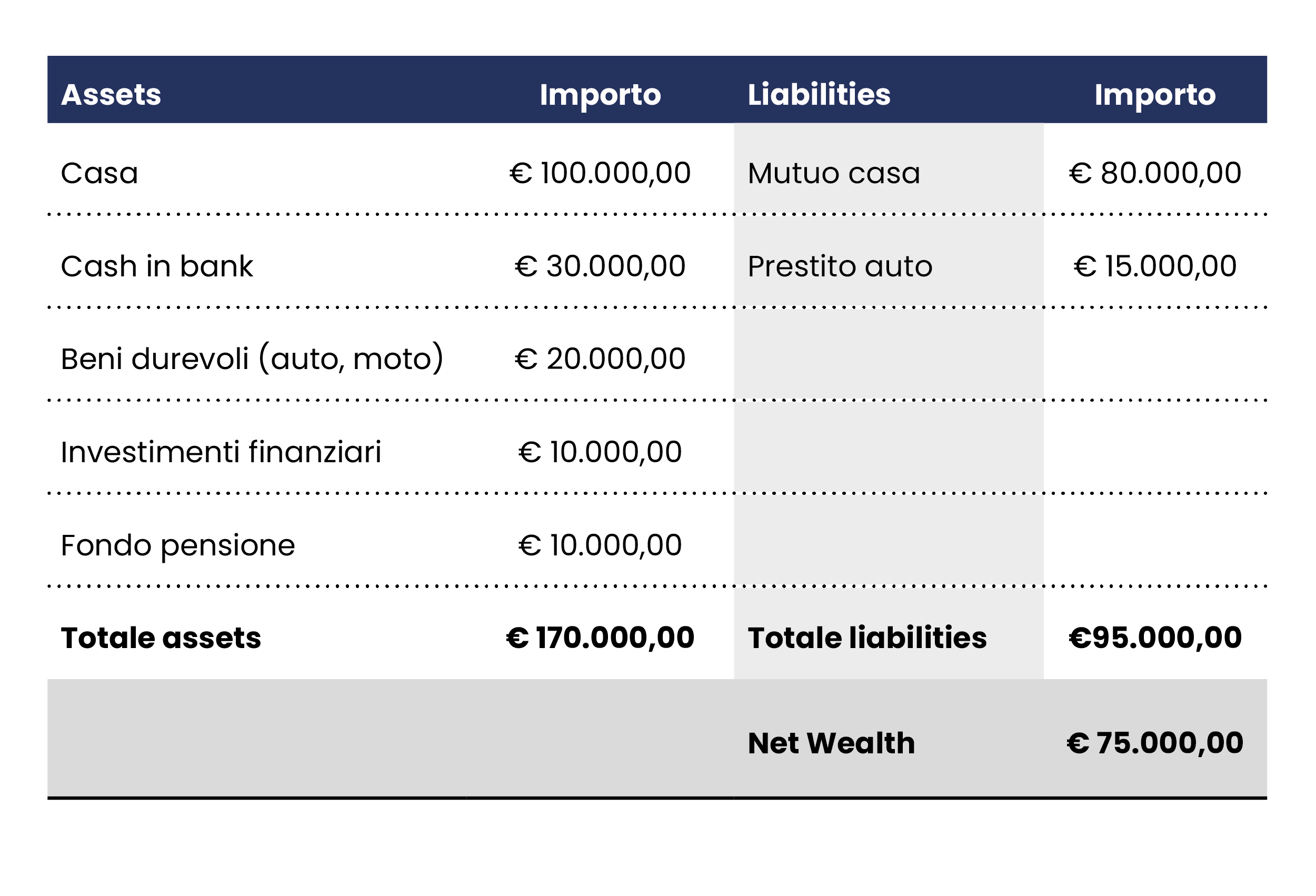

The formula to use is straightforward: you need to list all your assets, both real and financial, and subtract all liabilities. For convenience, you can do this as of December 31st and use that date to estimate the market value of some assets. This will be the first exercise to complete with the help of a spreadsheet.

Step One: Net Wealth

The first step involves listing all your major assets. Fill in the two columns representing assets and liabilities, as shown in the table below. In the assets column, you will need to provide an estimate of the value of the asset, while in the liabilities column, if applicable, the associated debt. Calculate the sum: the result will be a balance that can be either positive or negative. This balance defines your net wealth.

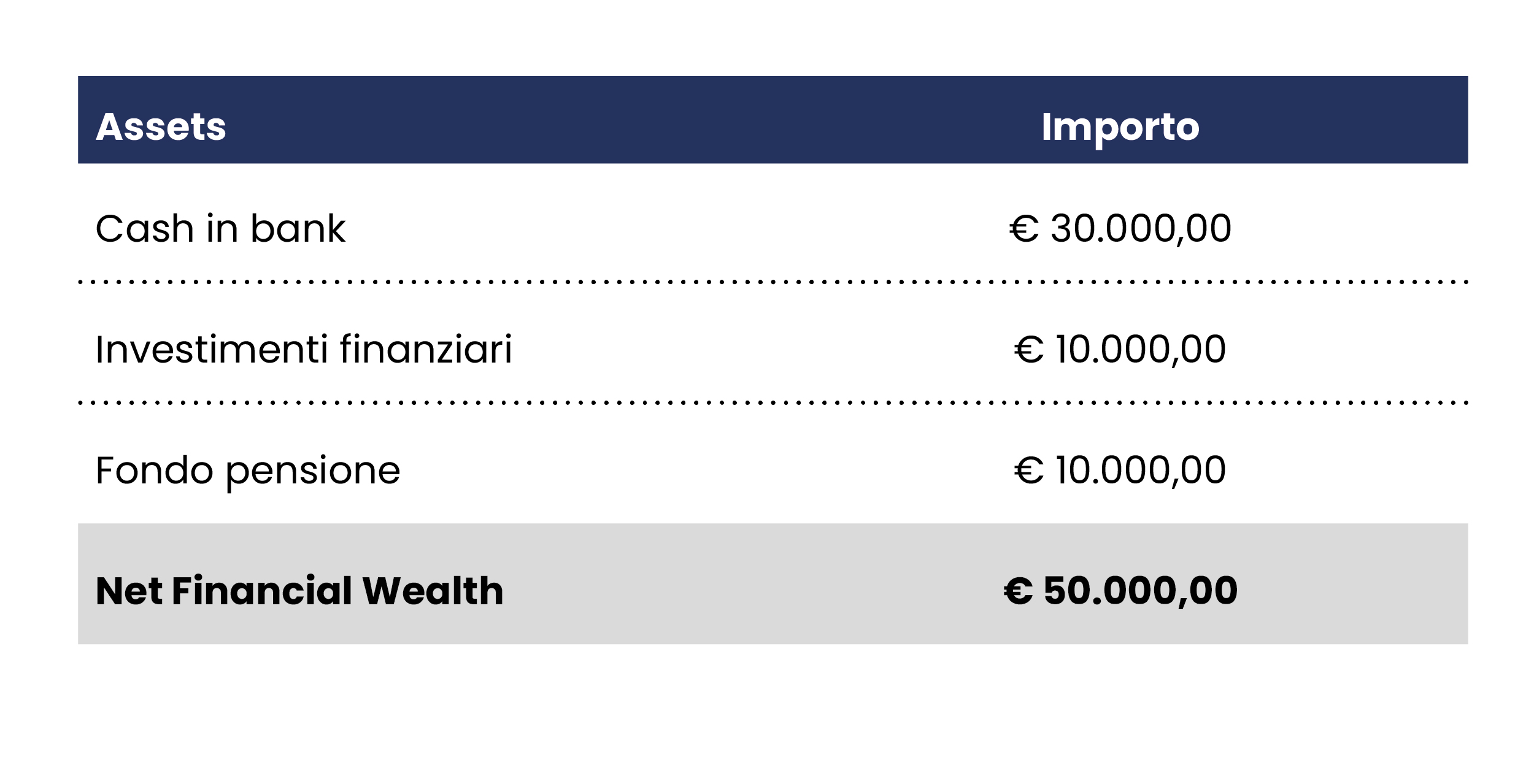

Step Two: Net Financial Wealth

Step Two: Net Financial Wealth

The second step involves removing all real assets from the list, such as real estate and vehicles. The purpose of this exercise is to measure net financial wealth.

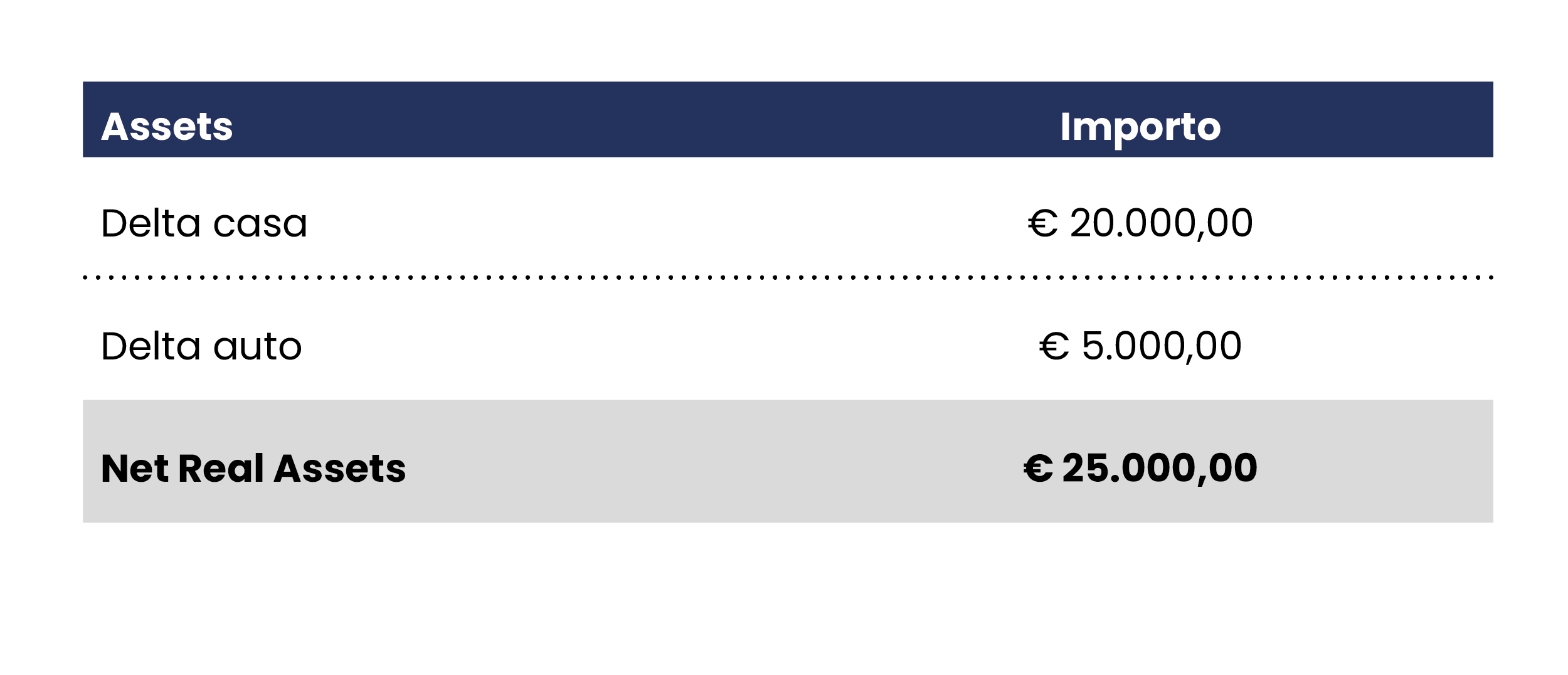

Step Three: Net Real Asset

For real assets, we need to take one more step and calculate the delta, which is given by the difference between the theoretical sale price and the debt. Again, this calculation can be positive or negative. Imagine selling your house on December 31st, subtracting the mortgage value, and you will have the delta.

The sum of financial assets (NFW) and real assets (NRA) minus liabilities will define your net wealth (NW)

In our example, this equals €75,000.

Aspects to Consider

There is more to consider. While the financial part is straightforward and “Net Financial Wealth” is indeed your financial wealth, real assets are more complex.

Even if you sell your house and pay off the mortgage, you still need a “roof over your head,” so you will need to pay rent, which, while not affecting your financial balance, will worsen your “income-expense” difference, which we will discuss later, and thus your savings capacity. When you pay a mortgage, which often isn’t very different from paying rent, you are partly paying interest (which goes into your expenses) and partly paying down capital, which reduces your debt and improves your “Net Real Assets.” The same considerations apply to a car. Unless you are among those who can do without, a car represents an expense you will still face. Even if you sell your current car, you will need to buy another one to replace it.

For these reasons, both for housing and cars, it is important not to overspend beyond your means. Being two essential assets in your life, you will still need to cover the related expenses, sometimes even letting yourself spend too much, which can significantly undermine your accumulation capacity. You should recognize that these two items (as well as others) are considered “investments” only in a broad sense. Especially, a car is an asset that depreciates very quickly rather than appreciating.

Understanding True Wealth

It is important to note that wealth is not just a matter of financial assets but also includes real assets and associated liabilities. Understanding the difference between financial wealth and real wealth can help you make more informed financial decisions and plan your future more effectively.

Moreover, we have seen how certain expenses, such as those related to housing and cars, can impact your savings capacity and wealth accumulation. It is crucial to evaluate these expenses carefully and ensure they are sustainable in the long term.

By using the data collected and the information obtained through this wealth assessment process, you will be able to develop an action plan to improve your financial situation and work towards your financial freedom.

In the next article, we will analyze the economic meaning of different forms of wealth and create a dashboard that will be extremely useful for tackling our journey towards financial freedom.

On avance!